While there have been a growing number of initiatives in recent years to evaluate companies’ environmental and social performance, they have dealt at best tangentially with the ways in which business responses to human rights risks can destroy, protect or create value for both business and society. Yet no aspect of business practice is more relevant for evaluating companies’ so-called ‘social performance’, since negative human rights impacts are by definition the most serious impacts a company can have on people. This paper, therefore, aims to promote deeper discussion of what this reality could and should mean for the field of accounting.

The paper is divided into two parts. Part A sets the context for the discussion. It looks briefly at today’s dominant and emerging paradigms for corporate governance and accounting and the extent to which they accommodate the value of business respect for human rights. In Part B, the paper explores the ways in which accounting models could evolve to better reflect and incentivize business respect for human rights. It considers two main questions:

- Can (and should) business respect for human rights be better reflected in current financial accounting methods?

The paper highlights two key constraints:

- Measurable costs to business of harm to human rights are frequently missed or misunderstood;

- Benefits to business from respecting human rights are often intangibles that cannot be readily measured.

__

- To what extent do (or could) new innovations in accounting accommodate respect for human rights?

The paper looks at the new paradigm offered by integrated thinking and reporting through the <IR> Framework, and reviews the extent to which the following innovations can enable integrated approaches to accounting that adequately reflect respect for human rights:

- Total Impact Measurement and Management

- Sustainability Accounting Standards Board (SASB) standards

- The Embankment Project

- The Social and Human Capital Protocol

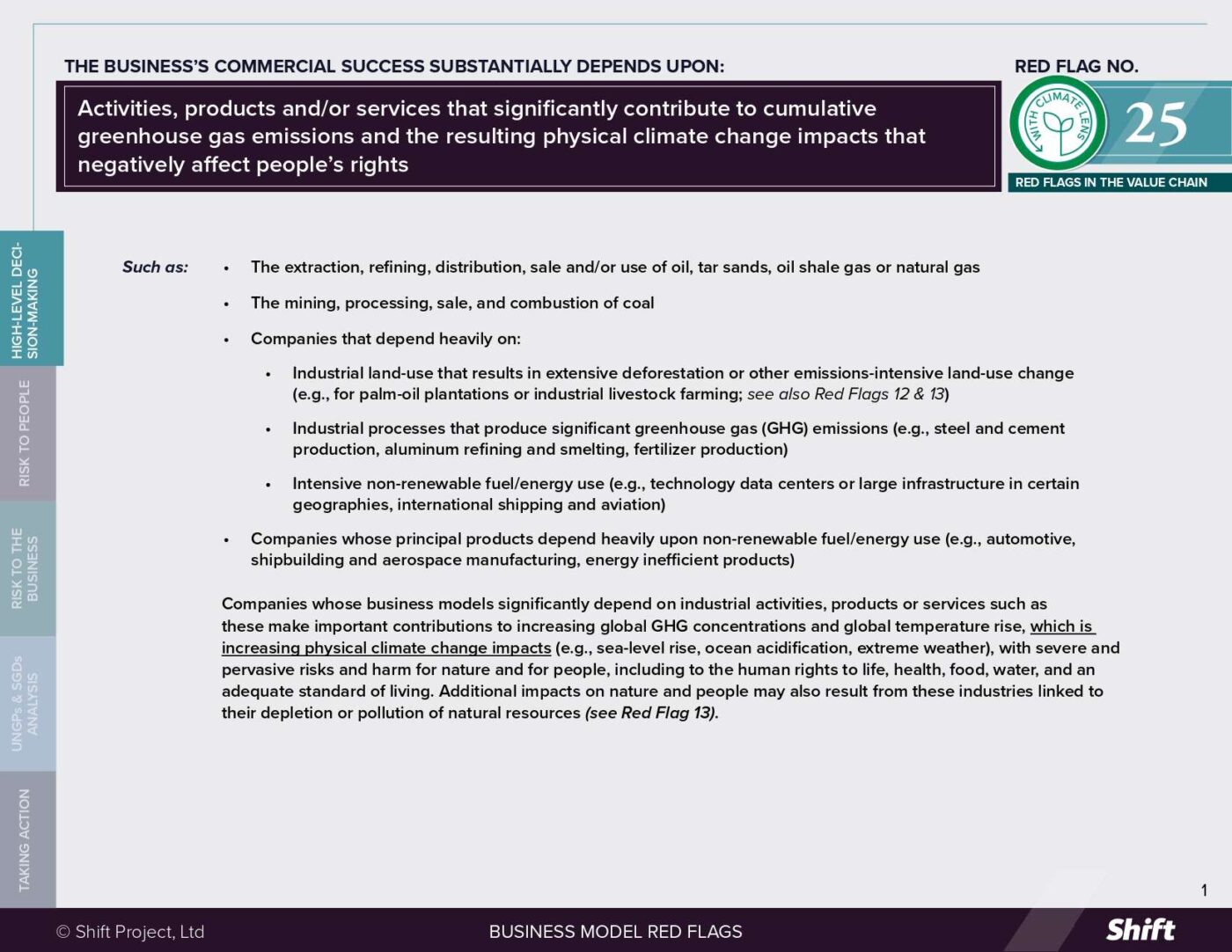

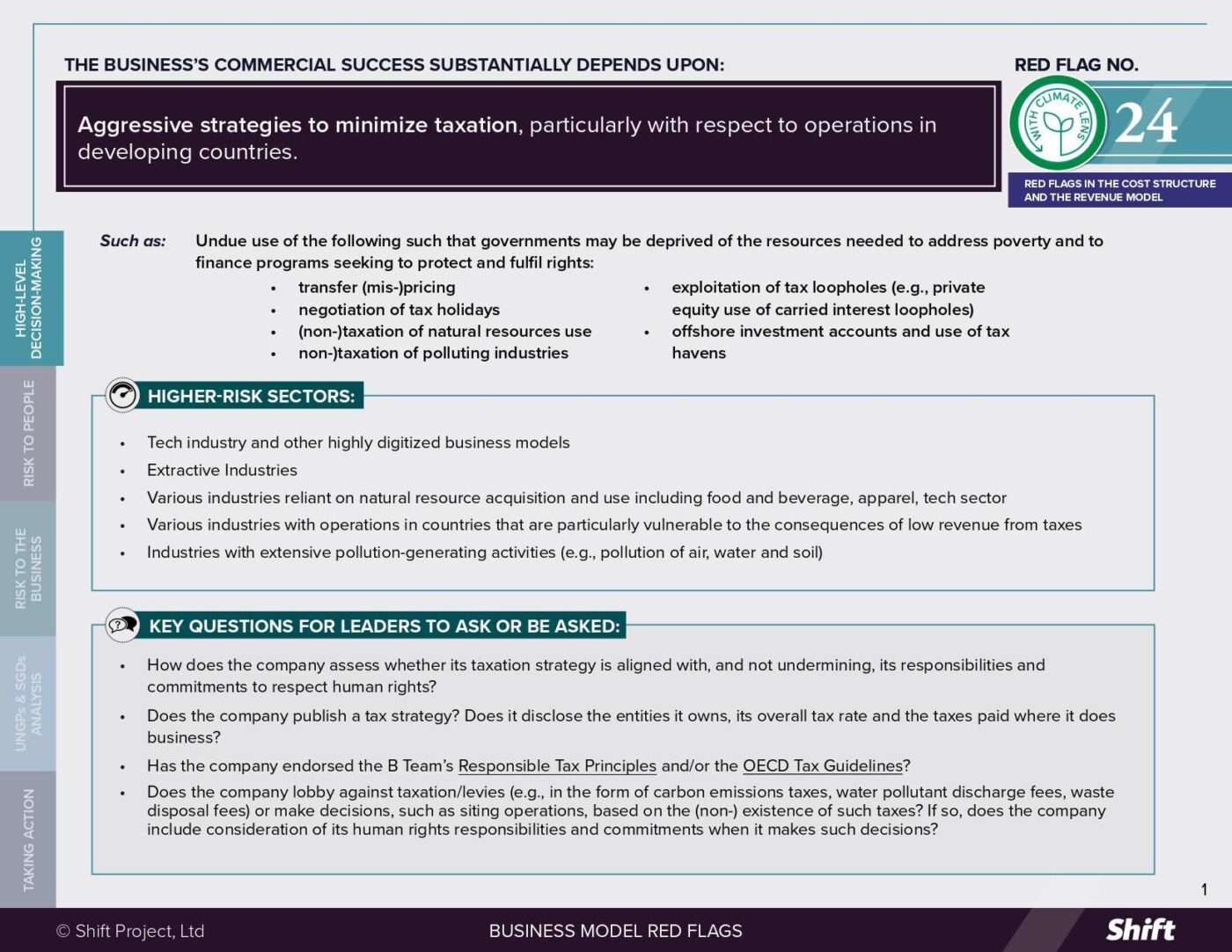

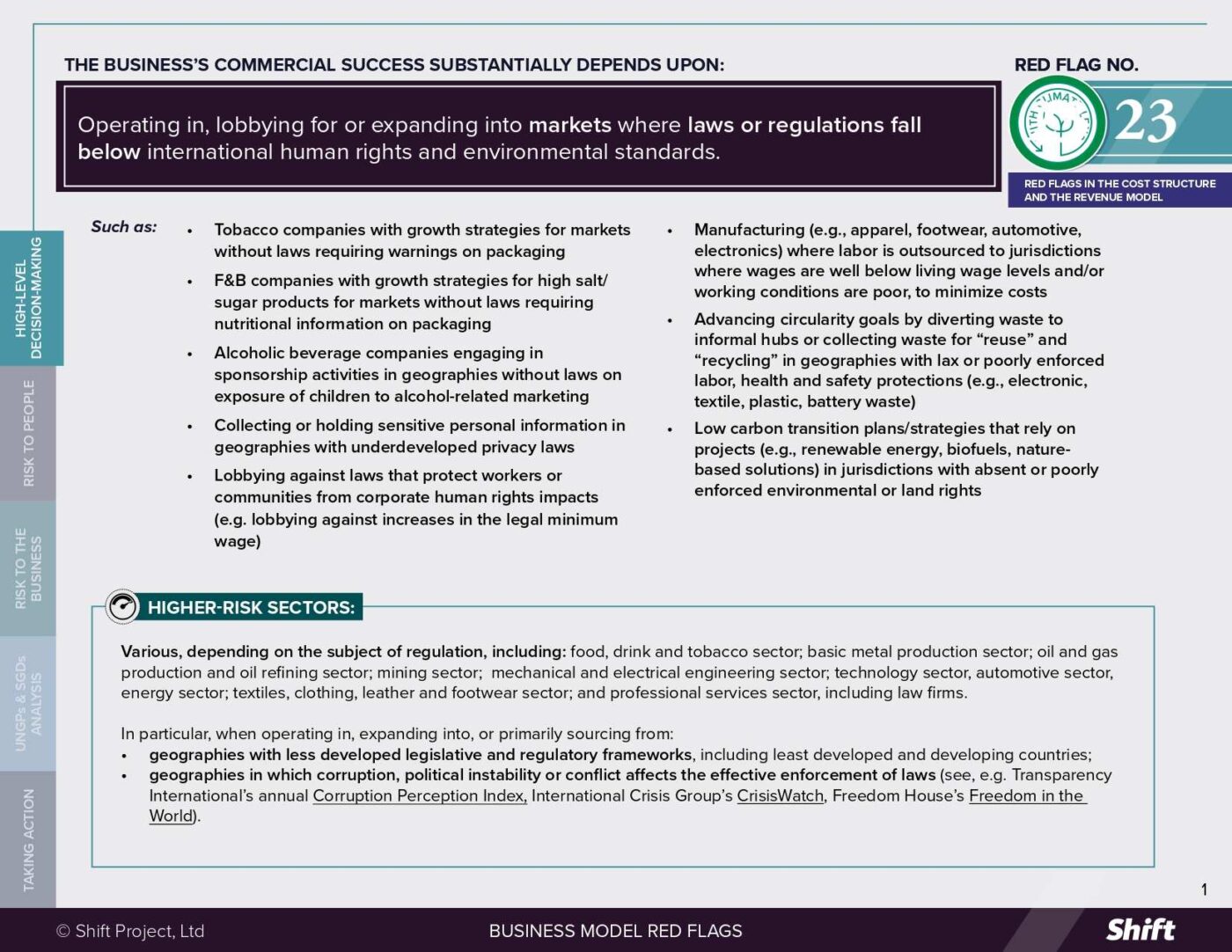

Business Model Red Flags

Business Model Red Flags  Tool for Indicator Design

Tool for Indicator Design