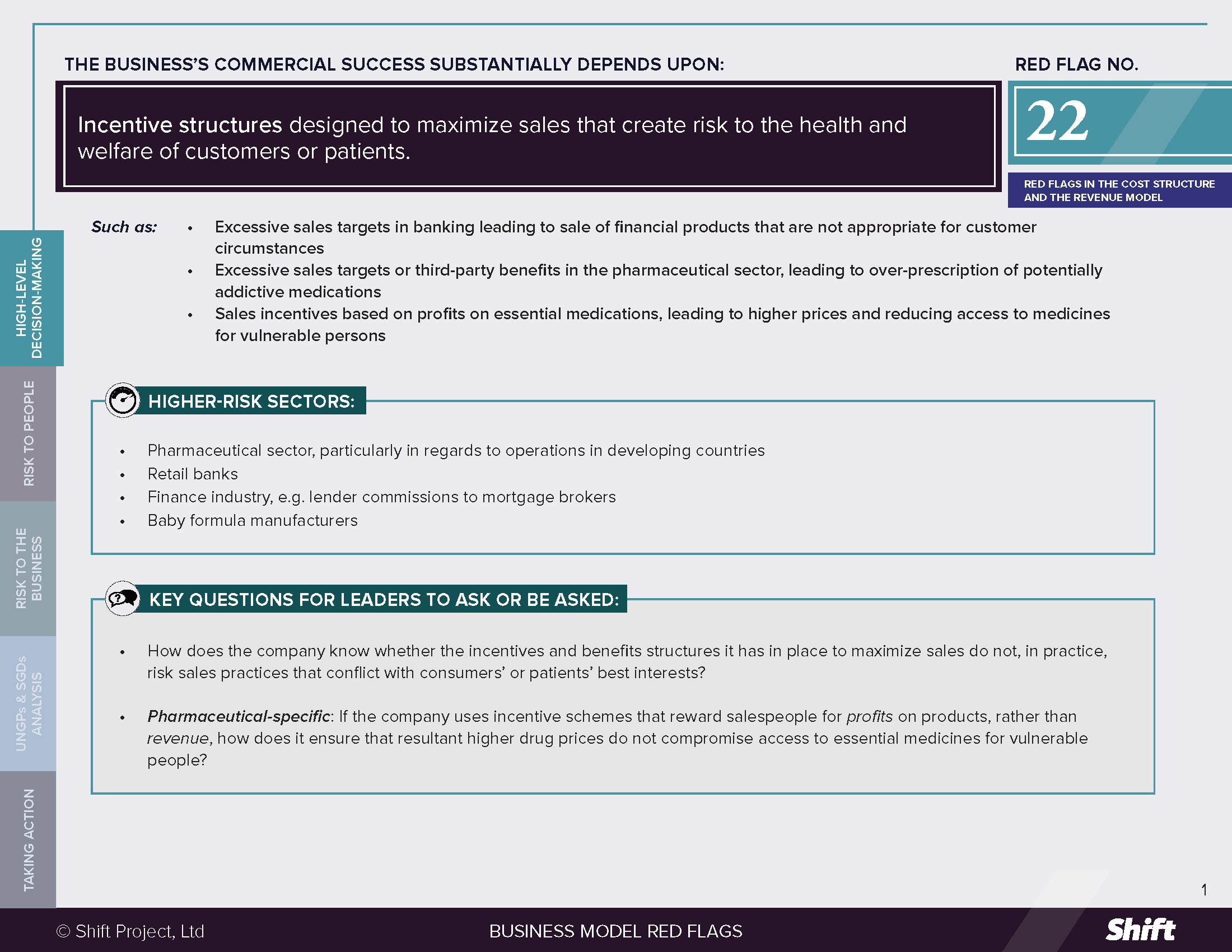

RED FLAG # 22

Incentive structures designed to maximize sales that create risk to the health and welfare of customers or patients.

For Example

- Excessive sales targets in banking leading to sale of financial products that are not appropriate for customer circumstances

- Excessive sales targets or third-party benefits in the pharmaceutical sector, leading to over-prescription of potentially addictive medications

- Sales incentives based on profits on essential medications, leading to higher prices and reducing access to medicines for vulnerable persons

Higher-Risk Sectors

- Pharmaceutical sector, particularly in regards to operations in developing countries

- Retail banks

- Finance industry, e.g. lender commissions to mortgage brokers

- Baby formula manufacturers

Questions for Leaders

- How does the company know whether the incentives and benefits structures it has in place to maximize sales do not, in practice, risk sales practices that conflict with consumers’ or patients’ best interests?

- Pharmaceutical-specific: If the company uses incentive schemes that reward salespeople for profits on products, rather than revenue, how does it ensure that resultant higher drug prices do not compromise access to essential medicines for vulnerable people?

How to use this resource. ( Click on the “+” sign to expand each section. You can use the side menu to return to the full list of red flags, download this Red Flag as a PDF or share this resource. )

Understanding Risks and Opportunities

Risks to People

Incentive and benefit structures, a key component of the sales promotion strategy of many companies, are designed to reward salespeople for revenue generated for the business. However, such structures can lead to negative outcomes for people where targets are excessively high, practices are subject to inadequate oversight, promotion activities towards third parties lead to over – or inaccurate prescription or recommendations, and, in some cases, where incentives are profit-based.

- Excessive sales targets and inadequate oversight can lead to predatory sales behavior. In the retail banking industry, this has included:

- Unauthorized transactions on client accounts;

- Sale of insurance products to clients who do not meet eligibility requirements (and therefore cannot take advantage of them);

- Targeting the elderly or people conversing in their second language;

- Sale of loans to people who cannot meet repayment obligations. (Privacy and Information rights; Economic security rights; Right to an adequate standard of living; Right to housing).

- Heightened risks arise where salespeople are required to use discretion in evaluating customer fitness for access to a product and/or have the ability to access/ modify private customer information without adequate oversight.

- Influencing third parties leading to excessive or inappropriate prescription or recommendation of products: Where incentive structures influence a professional’s exercise of discretion, people may be given advice or products that are not appropriate for their personal circumstances, affecting their health and/or finances:

- Provision of baby formula to mothers in poverty by hospitals/ doctors receiving samples from companies, with subsequent impact on child health as mothers abandoned breastfeeding but could not afford an adequate amount of formula (see OHCHR) (Right to life; Right to health);

- Sale of “sub-prime” loans by mortgage brokers receiving commissions from lenders, at interest rates above market and/or to borrowers who could not afford repayments (see CESR) (Right to an adequate standard of living, including Right to Housing); and

- Over-prescription of potentially addictive painkillers facilitating or leading to addiction (Right to life; right to health).

- In the context of essential medicines, sales incentives that reward based on profits on products (rather than revenue) can drive up the price of essential medicines, reducing access to medicines for vulnerable persons (Right to life; Right to health).

Risks to the Business

- Reputational, Financial and Business Opportunity Risks: Scrutiny from governments, investors and civil society is becoming increasingly sophisticated and granular, including to the level of the existence and effect of sales targets. One example is the well-known Access to Medicine Index for the pharmaceutical industry, which includes Market Influence within its measurement areas, including “sales-based performance incentives and bonuses for sales agents.” Consequently, companies are unable to claim ignorance of expectations and best practices; to do so risks loss of investment, reputational risks and loss of access to business partners applying such standards in their criteria for engagement.

- Regulatory Risks: The impacts flowing from excessive sales targets and inadequate oversight can affect the reputation of an entire industry and potentially lead to increased regulation. The Banking Royal Commission in Australia was established in 2017 to inquire into and report on misconduct in the banking, superannuation and financial services industry, including fraudulent lending to elderly customers and the widespread provision of inappropriate and predatory financial planning advice. It was reported in 2020 that “about 40 pieces of … legislation sit on [the government’s] parliamentary agenda.”

- Reputational, Financial, Business Continuity, Regulatory and Legal Risks: As the impacts associated with this red flag tend to accumulate over time and exacerbate exiting social vulnerabilities, when impacts reach public consciousness, they tend to do so explosively, in the form of scandals, exposés and the partial collapse of industries. Companies face resulting litigation, increased scrutiny and regulation and reputational damage. For example, in the context of aggressive sales tactics and over-prescription in the opioid crisis, drug companies faced lawsuits, saw their reputation damaged and stock lose value. Reportedly 70% of Americans support “making drug companies pay the cost of addiction treatment services and cover the cost of naloxone, used to revive people who’ve overdosed.”

What the UN guiding principles say

*For an explanation of how companies can be involved in human rights impacts, and their related responsibilities, see here.

The UNGPs note that companies should “strive for coherence between their responsibility to respect human rights and policies and procedures that govern their wider business activities and relationships. This should include, for example, policies and procedures that set financial or other performance incentives for personnel…”. (Principle 16, Commentary).

- Where salespeople undertake predatory or unethical behavior on behalf of the company, the company may cause any human rights impacts suffered by customers as a result.

- Where companies offer certain kinds of incentives in higher risk contexts, they risk contributing to impacts, e.g. if a pharmaceutical company operating in countries where access to medicine is a salient risk does not take steps to decouple incentive schemes from the cost of essential medicines.

- Companies that offer incentives to third parties in order to sway their advice to customers/patients may contribute to impacts suffered by those that receive inappropriate advice or products.

Possible contributions to the SDGs

Addressing risks to people associated with this red flag indicator can contribute to, inter alia:

SDG 1: No Poverty, in particular Target 1.4: By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property, inheritance, natural resources, appropriate new technology and financial services, including microfinance.

SDG 3: Good Health and Well-Being, in particular Target 3.5: Strengthen the prevention and treatment of substance abuse, including narcotic drug abuse and harmful use of alcohol. Target 3.8: Achieve universal health coverage, including financial risk protection, access to quality essential health-care services and access to safe, effective, quality and affordable essential medicines and vaccines for all.

SDG 8: Decent Work and Economic Growth, in particular Target 8.10: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

Taking Action

Due diligence Lines of Inquiry

Promotional practices influencing third parties

- Do we have a policy in our marketing practices with regard to potential human rights impacts, and do we include our marketing practices as part of our human rights due diligence?

- What evidence do we have as to whether our salespeople are acting in practice in line with our marketing policies and prescribed processes?

- What are the different contexts in which our products/services will be sold/recommended to individuals? How might poverty, a lack of information or other vulnerabilities affect potential impacts from our products? What strategies do we have in place to ensure that our products are not sold/recommended in circumstances where the products might lead to harm to our customers?

- Do we provide adequate training to our sales professionals to enable them to make decisions guided by our human rights responsibilities?

- How might our salespeople, or the professionals they influence, be incentivized to act otherwise than in accordance with our policies?

- Do we have sufficient oversight over our salespeoples’ activities? How do we internally/ externally audit our practices?

- What grievance mechanisms do we have, who can access them and how do we act on results?

Sales targets and predatory sales behavior

- Who are our most vulnerable potential customers? How can our products/ services potentially be connected to negative impacts on people?

- Do our salespeople exercise discretion in evaluating the appropriateness of a product for customer? How is this guided or constrained?

- How can we track any increases in sales to potentially vulnerable people?

- In practice, how do our salespeople experience the relative pressures to both deliver on sales targets and protect vulnerable people from potential impacts associated with our products/services? Do they find the two to be in tension and do they know how to address those tensions in practice?

- Do our salespeople have the ability to access/modify private customer information? What protections/ oversight is in place?

Profit-based incentives and access to medicine

- How do we incentivize our sales teams across geographies in which we operate? Do our incentive structures reward for profits on products (as opposed to revenue)?

- Could our incentives structures be playing a role in high/ rising drug prices?

- If so, do we whether higher prices could exacerbate existing vulnerabilities among potential consumers and limit access to essential medicines?

- Can we find a way to decouple sales agents’ incentives from sales targets?

Sales incentives and over-prescription in pharmaceuticals

- Do we offer sales bonuses based on sales volume in the context of drugs prone to over-prescription?

- Could we avoid deploying sales agents for such medicines, or decouple sales bonuses from volumes?

Mitigation Examples

*Mitigation examples are current or historical examples for reference, but do not offer insight into their relative maturity or effectiveness.

Removing sales-based incentives:

- According to the 2018 Access to Medicines Index, GSK’s sales agents’ rewards are not solely based on sales targets. Instead, it “rewards other qualities such as technical knowledge and quality of service” (p.134). Novartis also “rewards other aspects such as performance, innovation, collaboration, courage and integrity” (p.138).

- In order to “help our customers out rather than catch them out with unexpected charges, short-term offers and products they do not need,” Natwest and Royal Bank of Scotland “remove[d] sales-based incentives from customer-facing employees in Personal and Business Banking, ensuring that staff are completely focused on meeting the needs of customers rather than selling products.” To mitigate the impact on salespeople, the banks “gave every eligible employee an increase to their guaranteed pay.”

- To address over prescription, pharmaceutical companies Cipla and Shionogi have “minimised the incentive to oversell by decoupling their sales agents’ financial rewards from the volume of antibacterial and antifungal medicines they sell.”

Alternative Models

Avoiding sales agents altogether: Johnson & Johnson, Otsuka and Teva do not deploy sales agents for at least some antibacterial and antifungal medicines.

Other tools and Resources

- Sales Incentives and Over Prescription: The Access to Medicine Foundation’s Antimicrobial resistance benchmark “evaluates how 30 pharmaceutical companies are responding to the global threat of antimicrobial resistance” including their sales promotion practices.

- Profit-based Incentives and Access to Medicine: Information on pharmaceutical companies’ performance on “Market Influence,” including sales incentives, can be found in the Access to Medicine Index.

- Financial Services Misconduct: e.g., Submission of Dr. Kym Sheehan and Prof. David Kinley of Sydney Law School to the Australian Royal Commission into Misconduct in the Banking and Financial Services Sector.

- Misleading marketing practices of infant formula in developing countries: OHCHR (2015) Breastfeeding a matter of human rights, say UN experts, urging action on formula milk.

Business Model Red Flags

Business Model Red Flags  Tool for Indicator Design

Tool for Indicator Design