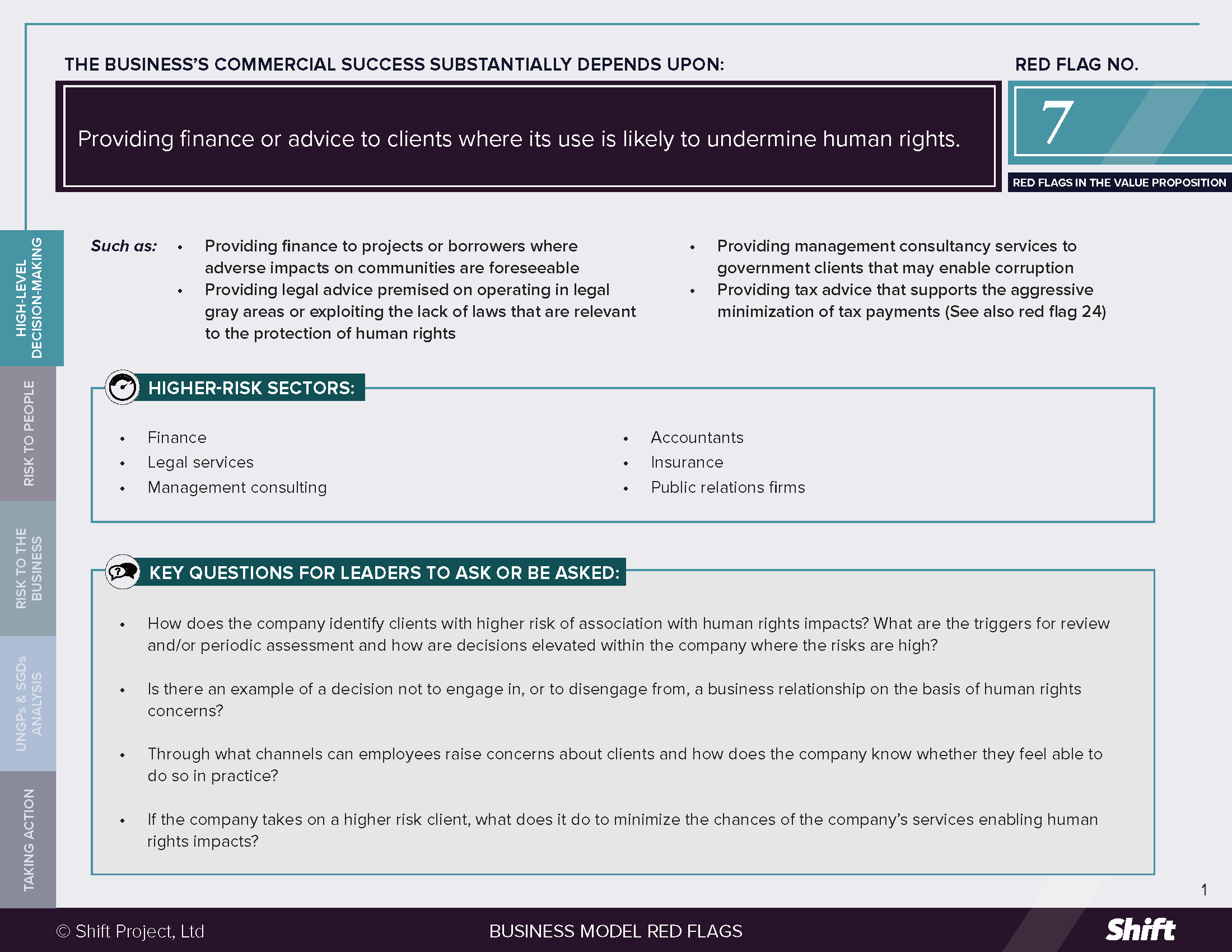

RED FLAG # 7

Providing finance or advice to clients where its use is likely to undermine human rights.

For Example

- Providing finance to projects or borrowers where adverse impacts on communities are foreseeable

- Providing legal advice premised on operating in legal gray areas or exploiting the lack of laws that are relevant to the protection of human rights

- Providing management consultancy services to government clients that may enable corruption

- Providing tax advice that supports the aggressive minimization of tax payments (See also Red Flag 24)

Higher-risk sectors

- Finance

- Legal services

- Management consulting

- Accountants

- Insurance

- Public relations firms

Questions for Leaders

- How does the company identify clients with higher risk of association with human rights impacts? What are the triggers for review and/or periodic assessment and how are decisions elevated within the company where the risks are high?

- Is there an example of a decision not to engage in, or to disengage from, a business relationship on the basis of human rights concerns?

- Through what channels can employees raise concerns about clients and how does the company know whether they feel able to do so in practice?

- If the company takes on a higher risk client, what does it do to minimize the chances of the company’s services enabling human rights impacts?

How to use this resource. ( Click on the “+” sign to expand each section. You can use the side menu to return to the full list of red flags, download this Red Flag as a PDF or share this resource. )

Understanding Risks and Opportunities

Risks to People

Financial or advisory services can enable companies to act in ways that increase the risk of impacts on people. Further, risks to people can arise even where financial or advisory services are provided in compliance with applicable laws and regulations. Some examples of human rights impacts connected to such services are listed below.

- Providing finance, insurance or advice for large infrastructure or other projects requiring relocation of communities can, without proper mitigation measures, be associated with forced relocation, the loss of adequate housing and livelihoods, the destruction of sacred indigenous sites, environmental damage and violence against community members. Where the advice relates to a project or facility in a geography undergoing conflict, there is a risk of connection to impacts on the right to life. In the case of finance, risks can be exacerbated where a financier is a non-lead bank in cases of multi-bank syndicated loans for project finance. (See Red Flag 15).

- In February 2021, the Telegraph reported that “consulting firm McKinsey has agreed to pay $573 million” in order “to settle claims by US states that the consulting company helped fuel the opioid epidemic by providing marketing advice to drugmakers including Purdue Pharma and Johnson & Johnson.”

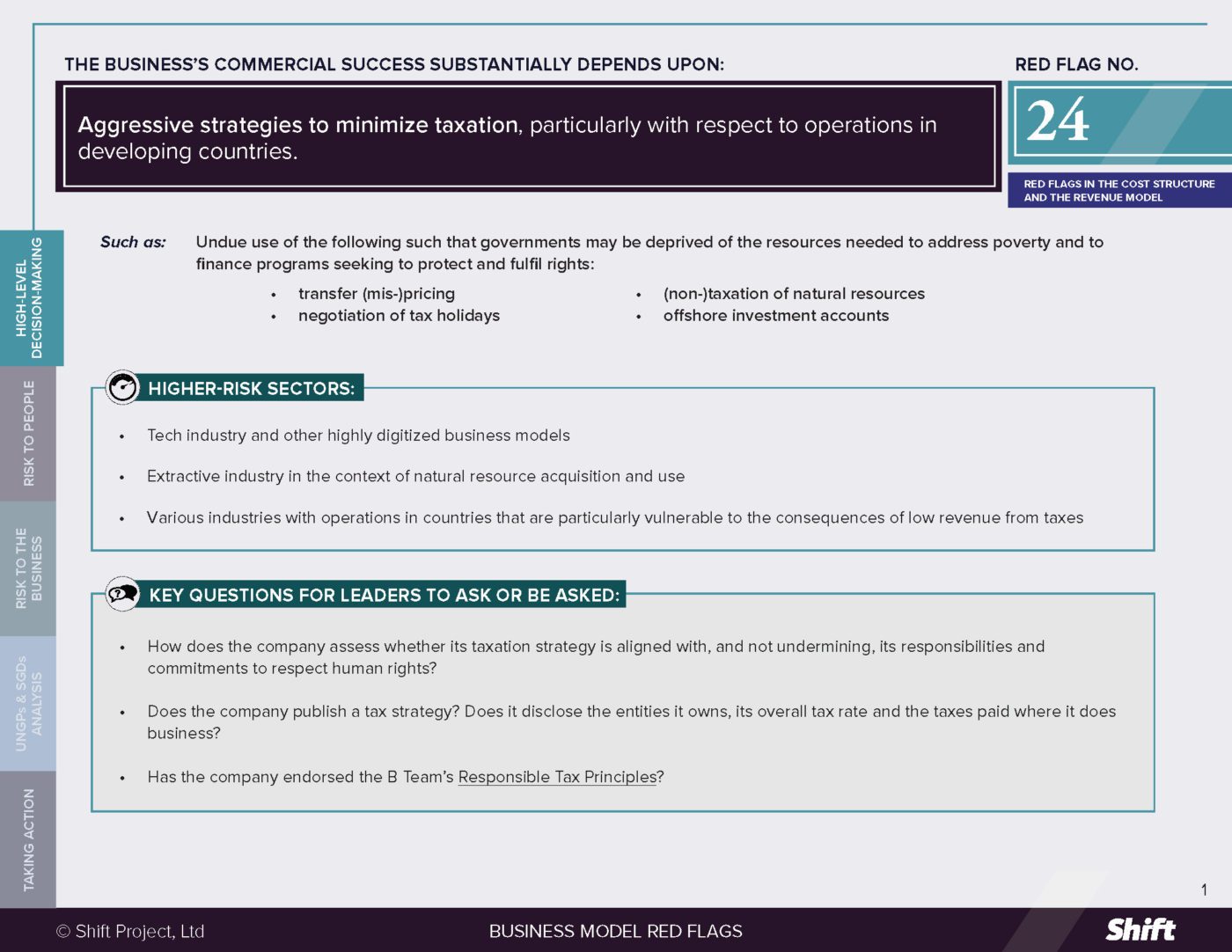

- Accounting and Taxation advice on aggressive, but legal, taxation minimization strategies can deprive governments of the resources needed to address poverty and to finance programs seeking to protect and fulfil rights. (See also Red Flag 24).

- In relation to legal advice, risks can arise where there is a gap between domestic laws and international human rights standards. For example, advice to employers in relation to legal tactics to undermine labor rights can negatively impact the practical enjoyment of those rights, e.g. the right to collective bargaining. Advice on bringing certain claims under stabilization clauses in investment agreements with host governments (which provide protections for investors against future changes in law) can interfere with a State’s bona fide efforts to implement laws, regulations or policies in a non-discriminatory manner in order to meet its human rights obligations.

Risks to the Business

- Reputational Risks: Connection to severe human rights impacts can have reputational effects for financial and advisory service providers; where such connections are repeated or persist over time, it can lead to public questioning of the company’s social license to operate. In 2018 a Forbes opinion article cited connections to human rights impacts as the basis for asserting that “McKinsey & Co fails as a global leader.” At worst, it can bring an entire industry into disrepute. In 2020 an investigative article relying on the Luanda Leaks asserted that “consultants, accountants and lawyers provided vital support at each step of the way” and argued for the need for greater regulation over the “key role Western professionals play in maintaining an offshore industry that drives money laundering and drains trillions from public coffers.” Civil society is increasingly highlighting the connection between finance and advisory services and impacts, most visibly in campaigns for divestment by banks from companies or projects associated with human rights impacts, such as in the case of banks lending to the private prison industry.

- Financial Risks: In February 2021, the Telegraph reported that “consulting firm McKinsey has agreed to pay $573 million” in order “to settle claims by US states that the consulting company helped fuel the opioid epidemic by providing marketing advice to drugmakers including Purdue Pharma and Johnson & Johnson.” Banks can be required to compensate communities for adverse impacts connected to their finance: in 2020 an Australian bank agreed to contribute the money that it earned from a loan to a sugar company to Cambodian families that were forcibly displaced by the company, as a form of contribution to remedy. This followed a decision in which the Australian National Contact Point found that it was “difficult to reconcile” the bank’s decision to take on the client “with its own internal policies and procedures” as the risks would have been “readily apparent.” Financial risks can also arise where banking clients are unable to repay loans due to the high costs associated with conflict with communities proximate to projects. Finally, pressure associated with a service provider’s connection to a human rights impacts can lead to them finding it necessary to end a business relationship, (e.g. in the case of the Dakota Access Pipeline), with financial consequences for the company.

- Business Opportunity Risks: Where advisors are unable to advise clients appropriately on the human rights risks associated with corporate decisions or activities, they risk losing business of increasingly sophisticated clients seeking these insights. The International Bar Association has noted that “lawyers, both as in-house counsel and as members of law firms, are increasingly asked to help businesses understand what the responsibility to respect human rights implies.” The Working Group on Business and Human Rights has noted a “[l]ack of understanding by some lawyers of the links between human rights risks, legal risks, commercial risk and reputational risks and, specifically, a failure to appreciate that, even where no material legal risks can be identified, that there can still be commercial and reputational consequences coming from a company’s behaviour, especially since the endorsement of the Guiding Principles and the growing focus … on the company’s performance on managing human rights risks.”

What the UN guiding principles say

*For an explanation of how companies can be involved in human rights impacts, and their related responsibilities, see here.

- While it is typically the client, rather than the provider of financial or advisory services, that is directly causing the harm to human rights in these contexts, the services provider is itself a business enterprise with a responsibility to respect human rights.

- The service provider’s relationship to the impact is more likely to sit somewhere along the continuum between contribution and linkage. As noted by John Ruggie in the context of finance, a variety of factors can determine where on that continuum a particular instance may sit. They include the extent to which an advisor has enabled, encouraged, or motivated human rights harm by the client; the extent to which it could or should have known about such harm; and the quality of any mitigating steps it has taken to address it. Some examples are below:

- If a company provides financial or advisory services to a client, and the client, in the context of using the services, acts in such a way that it causes (or is at risk of causing) an adverse impact, the services provider will be directly linked to the impact through its business relationships.

- The UNGPs do not automatically require the service provider to end a relationship with a client as a result. Rather, they are expected to use their leverage – their influence over the client or other relevant parties – to seek to change the behaviors or practices causing the harm. If the company does not have sufficient leverage to influence the relevant parties, then it should seek to increase that leverage. And where the company cannot increase its leverage, it should consider disengagement from the relationship(s) taking into account several key factors, including whether disengagement would cause further human rights harms. (See Guiding Principle 19).

- If a company provides financial or advisory services to a client, and the client, in the context of using the services, acts in such a way that it causes (or is at risk of causing) an adverse impact, the services provider will be directly linked to the impact through its business relationships.

- If a company knew or should have known about human rights risks inherent in a project for which it is providing financial or advisory services, but does not take adequate steps to seek to get its client to prevent or mitigate them, it may be considered to have facilitated – and thus contributed to – any impacts that occur. In such a case, the financier/advisor should:

- cease its contribution,

- use its leverage to mitigate any remaining impact to the greatest extent possible

- provide for or participate in effective remedy processes.

- Disengagement from the relationship will not, in many cases, be sufficient to fulfill the responsibility to provide remedy where the financier/advisor has contributed to impacts.

Possible Contributions to the SDGs

Providing financial or advisory services to companies or governments in a way that supports human rights standards – by helping them to understand their own responsibilities or by seeking to use leverage with the client where risks to people arise – can contribute to various SDGs, including, but not limited to:

SDG 8: On Decent Work and Economic Growth.

SDG 10: On Reducing Inequalities.

SDG 12: On Responsible Consumption and Production.

SDG 16: On Peace, Justice and Strong Institutions.

SDG 17: on Partnerships for the Goals.

In 2020, “leaders from a host of law firms from across the globe” as well as accountancy firms, were amongst leaders to endorse a UN statement on co-operation in support of sustainable development goals, recognizing the critical role they play in doing “business in a better world.”

Taking Action

Due Diligence Lines of Inquiry

Adapted from Shift’s, Human Rights Due Diligence in High Risk Circumstances: Practical Strategies for Businesses: Identifying potentially higher risk customers/clients.

Example Diagnostic Questions:

Concerning the customer/client

- Do customers/clients have known and effective internal governance and accountability structures?

- Do they have known and effective processes for managing environmental, social and human rights risks?

- Do they have a record of, or reputation for, breaching the law?

- Do they have a record of, or reputation for, negatively impacting human rights?

- Are they known or likely to engage in corrupt practices?

- Are they in conflict with stakeholders?

- Is this a government owned or connected entity and does that suggest greater or lesser risk to human rights?

Does the structure or duration of the relationship significantly limit the business’ leverage?

Concerning the financial/advisory service provider

- How often do we remain sensitive to changes in the operating environment and the scope of services being provided to the client? Do we reevaluate the risks:

- prior to a new activity or relationship;

- prior to major decisions or changes in the operation;

- in response to or in anticipation of changes in the operating environment (e.g. rising social tensions)

- periodically throughout the life of an activity or relationship?

- How do we engage internal stakeholders (our people) in ways that:

- raise awareness of high risk circumstances

- create expectations about identifying and escalating these types of risks

- address potential disincentives to raising issues (e.g. revenue targets or culture)

- How do we use leverage with the client?

- What avenues of leverage do we consider and explore with regards to clients where there is a risk of human rights impacts? For example, can we increase the leverage available in collaboration with other stakeholders (eg. via a syndicate or through industry initiatives?)

- How do we track the effectiveness of our attempts to use leverage? How do we learn and adapt?

Mitigation Examples

*Mitigation examples are current or historical examples for reference, but do not offer insight into their relative maturity or effectiveness.

Stregthening Due Diligence: Financial and advisory services providers can put in place robust processes to check the impulse to make decisions based on profit alone when it comes to accepting clients, and ensure potential connections to impacts on people are included as vital considerations. Moreover, human rights due diligence requires financial and advisory services companies to take action where they identify a connection to an impact, including by using leverage with clients to improve outcomes for people.

- When it conducts due diligence on specific clients, Dutch bank ABN Amro uses a wide variety of sources that inform it about the views of local communities or unions. In the due diligence process, ABN’s assessment includes:

- the client’s policies and practices in dealing with human rights relevant to its operations;

- whether the client’s policies and practices follow international standards;

- the client’s track record on respecting human rights

- the client’s human rights due diligence processes and the monitoring of its human rights performance.

- ABN also conducts regular training on due diligence (including escalation processes) for key departments involved in credit, front office, “Know Your Client” and credit risk processes; holds quarterly meetings between sustainability departments, business lines and senior management to discuss progress of human rights performance, and holds regular meetings between sustainability teams and business teams to enable smoother decision making at deal time. The bank has mapped the diamond value chain and used the results to issue client briefings and guides.

- Insurer Allianz reports that it has developed a human rights due diligence process as part of its overall ESG approach, which is integrated into the broader risk management system. The due diligence process uses a combination of a sector- and country approaches and Allianz has developed thirteen ESG guidelines for sensitive business sectors, which include sector-specific human rights aspects.

- In its “internal guide on human rights for mergers and acquisitions teams” Total demonstrates “recogni[tion] that human rights risk management needs to be integrated in legal risk management processes.” (See Working Group on Business and Human Rights).

- Using Leverage: In 2017 bank ABN AMRO announced that it was attempting to use its influence over ETE (parent company of ETP, a contractor in the Dakota Access Pipeline) “to strongly stress the need for it to influence ETP with a view to reaching an agreement that is suitable for all parties impacted, and that this solution be accomplished without violence and with FPIC [Free Prior and Informed Consent] at the forefront.” It halted new business with ETE and announced that “[i]f such a solution is not achieved, the ultimate consequence will be discontinuation of the relationship.”

- Collaborative Action: The banks that make up the Asia Pacific Banks Alliance have recognized the connection between finance and modern slavery via “retail accounts used to exchange funds with traffickers, forced labour in commercial supply chains, or investments being made in industries that have known issues with labour exploitation.” In collaboration with NGO The Mekong Club and the Thomson Reuters Foundation, they have developed modern slavery indicators tailored to the Asia-Pacific region, using case studies and data to inform outcomes and have “identified over 2000 victims of modern slavery.”

Other Tools and Resources

- Shift (2015) Human Rights Due Diligence in High Risk Circumstances: Practical Strategies for Businesses highlights strategies and practices that certain businesses have found most effective when conducting human rights due diligence in high risk circumstances. It includes “higher risk business relationships” such as those with customers/clients.

Finance:

- The Dutch Banking Sector Agreement’s paper on Enabling Remediation gathers some of the most recent thinking in relation to:

- how to understand the responsibility of a bank when connected to an impact through the activities of a client.

- the practical roles banks could play and actions a bank could take to enable remedy in practice, across all forms of responsibility.

- The Equator Principles Association’s EP4.

Legal Advice:

- A4ID’s The UN Guiding Principles on Business and Human Rights: A guide for the legal profession provides an analysis, with case examples, of:

- a law firms’ implementation of rights and responsibilities in client relationships.

- the relationship between the UNGPs and codes of professional conduct for the legal profession.

- International Bar Association’s Practical Guide on Business and Human Rights for Business Lawyers and Business and Human Rights Guidance for Bar Associations.

- IBA’s Handbook for company and commercial lawyers on Business and Human Rights, which provides an explanation for lawyers about the links between different kinds of risks.

- Principles for responsible contracts: Integrating the management of human rights risks into state-investor contracts.

- UNGC’s Good Practice Note Meeting the Responsibility to Respect in Situations of Conflicting Legal Requirements.

Taxation Advice:

- The B Team’s Responsible Tax Principles were developed through dialogue with a group of leading companies, convened by The B Team with contributions from civil society, institutional investors and international institution representatives.

Business Model Red Flags

Business Model Red Flags  Tool for Indicator Design

Tool for Indicator Design