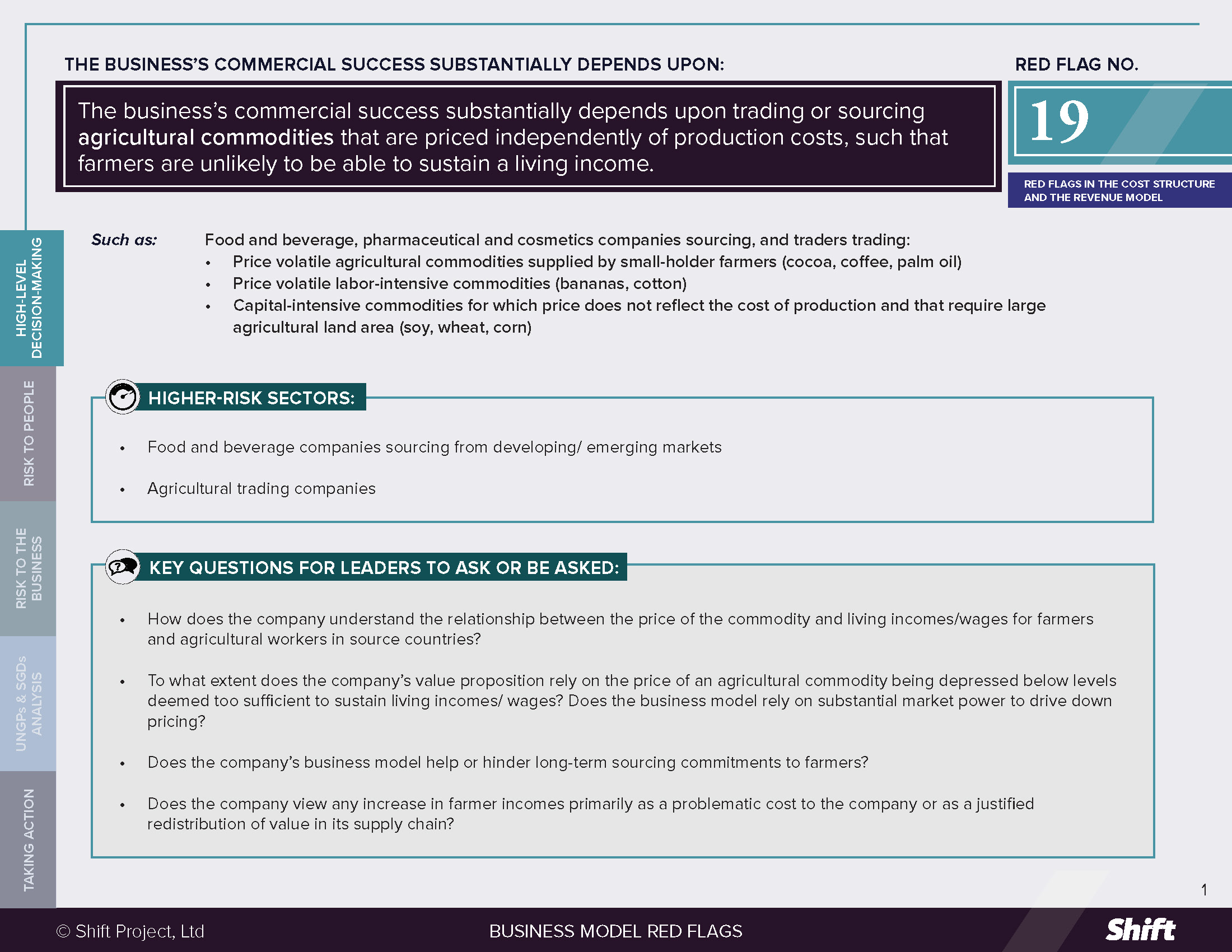

RED FLAG # 19

The business’s commercial success substantially depends upon trading or sourcing agricultural commodities that are priced independently of production costs, such that farmers are unlikely to be able to sustain a living income.

For Example

Food and beverage, pharmaceutical and cosmetics companies sourcing, and traders trading:

- Price volatile agricultural commodities supplied by small-holder farmers (cocoa, coffee, palm oil)

- Price volatile labor-intensive commodities (bananas, cotton)

- Capital-intensive commodities for which price does not reflect the cost of production and that require large agricultural land area (soy, wheat, corn)

Higher-Risk Sectors

- Food and beverage companies sourcing from developing/ emerging markets

- Agricultural trading companies

Questions for Leaders

- How does the company understand the relationship between the price of the commodity and living incomes/wages for farmers and agricultural workers in source countries?

- To what extent does the company’s value proposition rely on the price of an agricultural commodity being depressed below levels deemed too sufficient to sustain living incomes/ wages? Does the business model rely on substantial market power to drive down pricing?

- Does the company’s business model help or hinder long-term sourcing commitments to farmers?

- Does the company view any increase in farmer incomes primarily as a problematic cost to the company or as a justified redistribution of value in its supply chain?

How to use this resource. ( Click on the “+” sign to expand each section. You can use the side menu to return to the full list of red flags, download this Red Flag as a PDF or share this resource. )

Understanding Risks and Opportunities

Risks to People

- Of the estimated 500 million small-holder farmers worldwide, 200 million are producing food within global supply chains. Fifty percent of the world’s undernourished people are smallholders and their families.

- Farmers and smallholders have limited influence in negotiating terms of trade and receive an ever-diminishing share of the fruits of their labor.

- A range of structural barriers underlie this disadvantage, at the levels of the supply chain, commodity sector and public policy. ETI notes that business models intersect with these barriers in many ways, including:

- Consolidation of the market into a limited number of food retailers with substantial market power, that is often used to drive down prices and leave farmers unable to negotiate higher pricing.

- The effect of lowest cost or “discounter models” in the food retail sector, driving price competition and increased pressure on prices in the supply chain.

- Price squeezes on suppliers increase the risk of human and labor rights violations in food and farming supply chains, often affecting the most vulnerable in rural communities, including small-holder farmers, particularly women and migrant workers. The inability of a farmer to provide for his or her family leads to a considerable loss of dignity in some rural communities, increasing marginalization and compounding the risk of human rights impacts.

- With respect to some commodities, farmers and their families find themselves in a poverty trap: without funds or investment to grow high-quality produce or plan ahead, they face low prices and/or harvest early, reinforcing the poverty cycle. Farmers also face theft and are increasingly vulnerable to extreme weather events.

- Where lowest cost is the largest business driver, e.g. in the commodities market, farmers, fishermen and smallholders have limited influence in negotiating terms of trade and receive an ever-diminishing share of the fruits of their labor. [See also Red Flag 14]

- Poverty erodes or nullifies economic and social rights such as Right to health, adequate housing, food and safe water, and the Right to education (OHCHR).

Risks to The Business

Business Continuity Risks:

- Extreme price pressure on farmers can undermine availability of product and stability of supply in the near term and lead to an exodus from farming over time.

Reputational Risks:

- Undue price pressure on supply chains in certain geographies can lead to civil society exposés, resulting in damage and damage to reputation, brand and customer loyalty.

Business Opportunity:

- Focusing on improved livelihoods for people within the supply chain helps to bring them into the consumer base; failure to do so foregoes this opportunity.

What the UN guiding principles say

*For an explanation of how companies can be involved in human rights impacts, and their related responsibilities, see here.

The UNGPs note that companies should “strive for coherence between their responsibility to respect human rights and policies and procedures that govern their wider business activities and relationships [including] ….procurement practices.” (Principle 16, Commentary)

- Companies sourcing commodities through their supply chain from farmers who receive less than a living income may be directly linked to impacts on the adequacy of the farmers’ standard of living.

- If a company’s purchasing practices push costs upstream in the supply chain – whether alone or as part of an industry-wide behavior – in ways that prevent farmers from achieving a living income, they contribute to the impacts experienced by farmers.

Possible Contributions to the SDGs

Addressing impacts on people associated with this red flag indicator can contribute to, inter alia:

SDG 1: Eradication of poverty in all its forms.

SDG 10: Reduce inequality within and among countries.

Oxfam has noted that, “perpetually low income levels are one of the key reasons why farmers remain stuck in poverty… For many small- scale farmers, significant 2 exist between their actual income and income levels sufficient to ensure a decent standard of living…”. Oxfam cites structural barriers, including at the level of individual supply chains, which reinforce the “significant imbalance between the risks of agriculture shouldered by farmers and their power to shape their own market participation.”

By addressing the impacts on living income from corporate sourcing practices and price influencing, companies can contribute to lifting the poorest people in agriculture into more sustainable livelihoods, and in turn help them to escape poverty and realize their rights, from better health to nutrition to education.

Taking Action

Due Diligence Lines of Inquiry

- Are our purchasing practices designed to drive down pricing, or do they have the effect of doing so? How do we know?

- Are the length of our supply chain commitments/ contracts helping or hindering our ability to use our leverage to secure better prices for farmers?

- Have we explored increasing dialogue with, or forming partnerships with, farmers in our supply chain? Have we sought to understand the real costs associated with production of the commodity, based on their experience?

- Are we engaging in multi-stakeholder initiatives (MSIs) aimed at addressing human rights impacts with respect to the commodity on which we rely? Where a relevant MSI doesn’t exist, can we learn from analogous efforts and explore opportunities to create one?

- Have we explored how to engage and educate our customers if they must absorb some price increase to protect farmer living standards?

- Are we prepared to experiment – and learn from failures or missteps – in tackling the difficult challenge of livelihoods in supply chains? Can we explore opportunities to promote and facilitate the growth of new forms of business in our supply chain that can channel more resources to farmers (e.g. cooperatives, women- owned enterprises, social enterprises)?

Mitigation Examples

*Mitigation examples are current or historical examples for reference, but do not offer insight into their relative maturity or effectiveness

- The Farmer Income Lab, launched by Mars, with Dalberg and Wageningen universities and Oxfam USA, is a collaborative effort to identify ways to increase smallholder farmers’ incomes – beginning with Mars’ supply chains in developing countries – and to understand how to create positive outcomes for farmers at scale.

- Companies participating in the voluntary Sustainable Vanilla Initiative commit to pre-competitive projects to improve quality, product traceability, good market governance and the livelihoods of smallholder farmers who form the foundation of the global vanilla bean trade.

- ABI has set a goal that by 2025, 100% of its direct farmers will be skilled, connected and financially empowered. Their SmartBarley platform leverages data, technology and insights to help more than 5,000 enrolled farmers improve their profitability, as well as their efficient use of natural resources.

Alternative Models

- Oxfam has highlighted several examples of alternative models, including:

- UK company Sainsbury’s Dairy Development Group: farmers have full membership within the group and equal votes in decision making on milk price. In 2012, Sainsbury’s “removed itself from this volatile milk market and introduced a Cost of Production (COP) model which was voted in by the farmers themselves.”

- Private company Apicultura Lilian, in Honduras: the company has a sourcing strategy focused on establishing a direct link with honey producers; it distributes 10% of its profits to supplier network and provides technical support and inputs to increase yields.

- Some initiatives appear to aim at “de-commoditization”: An impact investing fund created by Danone, Firmenich, Mars and Veolia with respect to vanilla, offers a 10-year commitment, cooperative and a minimum price, through an “innovative model where formers and industry players share both the benefits and risks.” The project estimates that 60% of cured vanilla’s value will go back to farmers (compared to initially observed shares of 5% to 20%).

- Research in Progress: The Farmer Income Lab is conducting research and stakeholder dialogue to identify, inter alia, “models that unlock opportunities for women and lead to increased business value, as well as how to integrate these models into business strategies and measure progress in doing so.”

Other tools and Resources

- Oxfam (2018) A Living Income for Small-Scale Farmers: Tackling unequal risks and market power discusses the barriers to raising small- scale former incomes and entry points for change.

- Oxfam (2018) Fair value: Case studies of business structures for a more equitable distribution of value in food supply chains explores 12 case studies to demonstrate that equitable business structures, such as farmer-owned cooperatives, and business arrangements including long-term and transparent contracts, profit sharing and producer participation in pricing committees, can result in farmers receiving a greater share of the value of the food they produce.

- FAO (2015) Inclusive Business Models Guidelines for improving linkages between producer groups and buyers of agricultural produce. FAO has developed guidelines that contain, inter alia, useful methodologies for buyers seeking to organize farmers into suppliers, which includes contract farming or outgrower schemes.

- OECD-FAO Guidance for Responsible Agricultural Supply Chains provides guidance for enterprises across the agricultural supply chain, from the farm to the consumer, anchored by a “framework on risk-based due diligence.”

- On cocoa specifically, Peter Stanbury and Toby Webb’s How to deliver real sustainability in the cocoa sector? Collaborative development governance puts the case for cross-cutting, long-term action.

Business Model Red Flags

Business Model Red Flags  Tool for Indicator Design

Tool for Indicator Design