About the European Commission’s Omnibus Simplification Proposal on EU Sustainability Due Diligence and Reporting Laws

In 2024, the President of the European Commission announced that the Commission would bring forward a proposal to simplify requirements and reduce burdens on smaller companies, including in connection with the recently adopted Corporate Sustainability Due Diligence Directive (CSDDD) and the more established Corporate Sustainability Reporting Directive (CSRD). In February 2025, the Commission announced its ‘Omnibus Simplification Proposal’. While the goals are reasonable ones for European Union (EU) policy-makers to pursue, in fact the proposal risks making life more complicated for both large and small companies.

You can read Shift’s initial assessment of the Omnibus Proposal here. In it, we explain how the proposal would make it much harder for companies to ‘know and show’ that they are managing the human rights and environmental risks they face, and leave them on the back foot when they are ‘named and shamed’ by the media and NGOs when things go wrong in their supply chains.

Shift will continue to be actively involved in the Omnibus legislative process based on our mission to advance alignment of influential standards with the UN Guiding Principles on Business and Human Rights. We will regularly share resources and updates here, so please check back in or sign up to our newsletter here.

About the EU Corporate Sustainability Due Diligence Directive

Beginning in 2017, several European states including France, Germany and the Netherlands began to adopt versions of human rights due diligence legislation. This created momentum for the EU to help level the playing field.

In 2022, the EU began negotiating a draft Corporate Sustainability Due Diligence Directive (CSDDD) which was finally adopted in May 2024. During this time, Shift’s focus was on ensuring the CSDDD was anchored in the international standards on sustainability due diligence – the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises. Despite limitations with regard to the scope of companies covered under the Directive, and limited obligations with regard to due diligence on downstream impacts, the core content of the final law was substantially aligned with the UNGPs – making it more likely to be both impactful for people and planet and manageable for companies to implement. The Directive provides that EU Member States have two years to transpose it into their national laws. Enforcement would then commence one year later for the first batch of covered companies, with the others following after. The Directive was expected to cover more than 5500 companies. For more information, check out Shift’s responses to Frequently Asked Questions about the CS3D.

How should companies respond to the current regulatory uncertainty?

Given the uncertainties created by the Omnibus Proposal and negotiation process, our advice to companies that want to know how they should respond is simple – keep doing risk-based due diligence in line with the existing international standards. That remains the single best investment companies can make to prepare to meet current and future demands, whether from investors, lenders, customers, civil society or EU policy-makers as this process moves forwards.

Core Resources

Our analysis

5 resources

Frequently Asked Questions about the EU Corporate Sustainability Due Diligence Directive

In this resource, Rachel Davis (Co-Founder), and Ruben Zandvliet (Deputy Director for Standards), answer companies’ frequently asked questions about the new Corporate Sustainability Due Diligence Directive. Since the approval of the Corporate Sustainability Due Diligence Directive (CS3D) by senior officials from EU Member States in Council on 15 March, we’ve received numerous questions from companies […]

Aligning the EU Due Diligence Directive with the International Standards: Key Issues in the Negotiations

Aligning the CS3D with the core concepts in the international standards The EU is currently in the process of negotiating a legal instrument that will establish new corporate human rights and environmental due diligence duties across the single market – the draft Corporate Sustainability Due Diligence Directive (CS3D). At the heart of the negotiations is […]

Designing an EU Due Diligence Duty that Delivers Better Outcomes

What is the CS3D? Starting in 2022, the European Union has been negotiating a draft Directive on Corporate Sustainability Due Diligence (CS3D), with discussions on a final law expected to begin by mid-2023. The draft Directive aims to ensure companies active in the single European market contribute to sustainable development by preventing and addressing negative human rights and environmental impacts. […]

Shift’s Analysis of the EU Commission’s Proposal for a Corporate Sustainability Due Diligence Directive

On 23 February 2022, the European Commission released its ‘Proposal for a Directive of the European Parliament and of the Council on Corporate Sustainability Due Diligence. Its overall objective is to ensure that companies active in the internal market contribute to sustainable development …through the identification, prevention and mitigation, bringing to an end and minimization […]

“Signals of Seriousness” for Human Rights Due Diligence

This discussion draft is intended for the consideration of the European Commission and other stakeholders as the Commission develops proposals on mandatory human rights and environmental due diligence (mHREDD) and considers how national regulators would implement any such legislation. Shift is submitting this draft together with our formal response to DG JUST’s consultation on a […]

Previous Comments and Analysis by Shift

- Rachel Davis’ March 2022 COMMENTS to the European Parliament RBC Working Group on the release of the Commission’s proposal

- Our March 2022 ANALYSIS of the Commission’s proposal for a draft Directive

- Our October 2021 Key Design Considerations for the Enforcement of Mandatory Due Diligence, developed in collaboration with the Office of the UN High Commissioner for Human Rights

- Our August 2021 viewpoint on how legislating a new standard of conduct CONNECTS TO OUTCOMES FOR PEOPLE

- Our July 2021 viewpoint on the relationship between HUMAN RIGHTS AND ENVIRONMENTAL DUE DILIGENCE

- Our June 2021 viewpoint on the need to include SMEs in the scope of new regulations while allowing them APPROPRIATE FLEXIBILITY

- Our April 2021 recap of the mHRDD debate in Europe (see below)

- Our February 2021 RESPONSE to the European Commission’s initial consultation on the need for an initiative on sustainable corporate governance

Strengthening the S in ESG

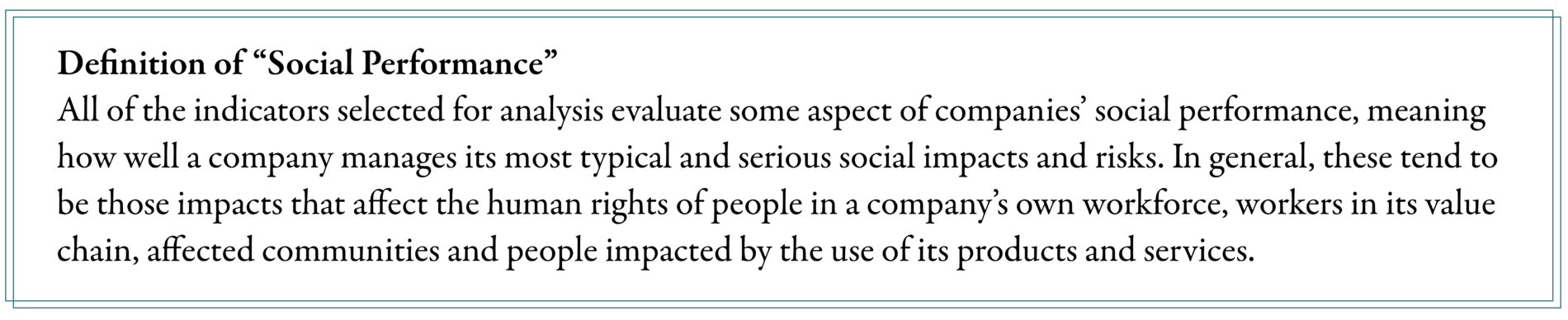

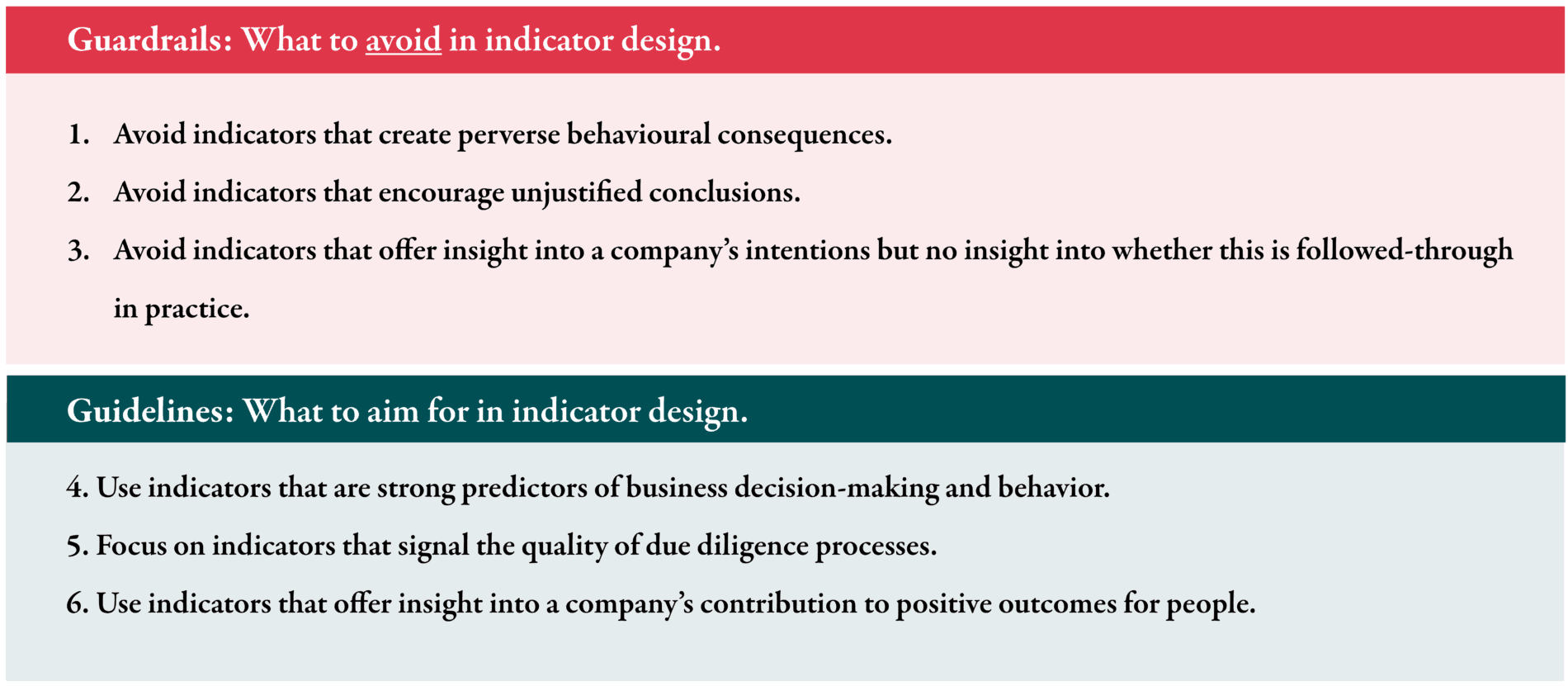

This series captures the research findings from our analysis of almost 1300 social and governance indicators used in ESG data providers’ products or reporting requirements.[1] In our Guardrails, we’ll focus first on the problems, spotlighting the types of indicators that offer minimal insight, or worse, incentivize poor practices. We’ll then turn to indicators and metrics that are more robust in our Guidelines, illuminating the pathway to better measurement.

Guardrails

A series of guardrails for designing better social indicators and metrics.

3 resources

Guardrail 01: Avoid indicators that create perverse behavioral consequences.

Guardrail 02: Avoid indicators that encourage unjustified conclusions.

Guardrail 03: Avoid indicators that offer insight into a company’s intentions but no insight into whether these are followed through in practice.

Guidelines

A series of guidelines for designing better social indicators and metrics.

6 resources

Introduction to Guideline 01: Use indicators that are strong predictors of business decision making and behavior.

Guideline 1: Use indicators that are strong predictors of business decision making and behavior.

A: Evaluating companies’ governance practices

Guideline 1: Use indicators that are strong predictors of business decision making and behavior.

B: Focus on Stakeholder Engagement indicators.

Guideline 1: Use indicators that are strong predictors of business decision making and behavior.

C: Focus on a company’s social targets.

Guideline 2: Use indicators that offer insight into the quality of a company’s due diligence.

Guideline 3: Use indicators that offer insight into a company’s contribution to positive outcomes for people.

Across the series, we will exemplify the good, bad and ugly of social indicators and metrics. Our research looked at indicators focused on specific issues like forced labor or indigenous rights or living wages, and on evaluations of companies’ governance, risk management processes, responsible supply chain initiatives, and stakeholder engagement. Our goal is not to offer yet another set of competing indicators, but to share what we’ve learned about good indicator design in order to inform healthy debate, collaboration and innovation to improve the S in ESG.

The series is for everyone and anyone working to improve the ways in which we evaluate companies’ social performance.

Advancing the S in ESG

The field of sustainability and responsible business conduct is faced with a significant opportunity: to coalesce around a core set of select, standardized indicators and metrics that meaningfully measure companies’ social performance regardless of their industry sector. This is key to equipping investors, business leaders, regulators and civil society with the tools to push to scale business practices that are in line with the principle of basic dignity and equality for all.

Success will significantly contribute to tackling inequalities, ensuring business actions towards net zero and net positive have the social license to proceed at the urgent pace required, and adapting business models and global value chains so that they deliver resilience to businesses and the stakeholders they impact. Failure risks ushering in more, already well-catalogued business-related harms and risks to people, planet and prosperity, likely with evermore multi-generational consequences.

The good news is that most stakeholders have embraced the pressing need for convergence around corporate sustainability reporting standards, including the indicators and metrics against which companies should disclose information and that should be used to evaluate corporate performance. Even better, recent institutional coordination and collaboration has set the stage for well-governed and inclusive processes needed to achieve such convergence.

Barriers to strengthening the S in ESG

Any ambitious project has risks that need managing. The challenge of building consensus across diverse stakeholders around indicators and metrics that offer credible insight into a company’s social performance is no exception.

Some risks are the consequence of positive dynamics. For example, the welcome growing attention to the S in ESG has resulted in thousands of social indicators and metrics already being developed by mainstream data providers and more targeted ranking and rankings. But the risks is that in a bid to identify a smaller set of indicators, we select the most commonly used indicators, in spite of broad recognition that these may not be fit for purpose.

In addition, the urgent need to effect a step change in the scale and quality of corporate reporting and assessment on social issues also carries the risk that project timelines prevent us from interrogating the devil in the detail of indicator formulations, such as when indicators may have perverse, unintended consequences.

The consequence of such risks is more than inconvenience and frustration. We could end up with solutions that confuse decision-makers, reflect the lowest common denominator of thinking and practice, or fail to ward off critiques of blue-washing and corporate capture, but also of so-called woke capitalism.

Guardrails and guidelines for indicator design

In climbing, guidelines are cords or ropes to aid passers over a difficult point or to permit retracing a course. Guardrails are physical barriers used to prevent people from falling from a height or from straying from a pathway or road into dangerous areas. So, both are put in place when the journey and terrain may be hard to navigate.

In the context of designing social indicators and metrics, we need both guardrails and guidelines, so we’ve structured our initial findings within the series around these.

If we fail to reclaim the measurement of companies’ social performance as a tool to advance business respect for human rights, the S in ESG will remain divorced from the investor and business decisions that determine whether business is done with respect for people’s dignity. We hope this series can play a part in sustaining, advancing and scaling practices that lead to better outcomes for workers, communities and the people impacted by the use of products and services.

[1] Shift was unable to verify whether the non-public indicators and metrics that we used for our analysis are the most up to date versions used by data providers at the time of writing (April 2024). We also recognize that the underlying methodologies used to reach a judgement on a company’s performance against an indicator may offer more nuance that we could not access for our research.

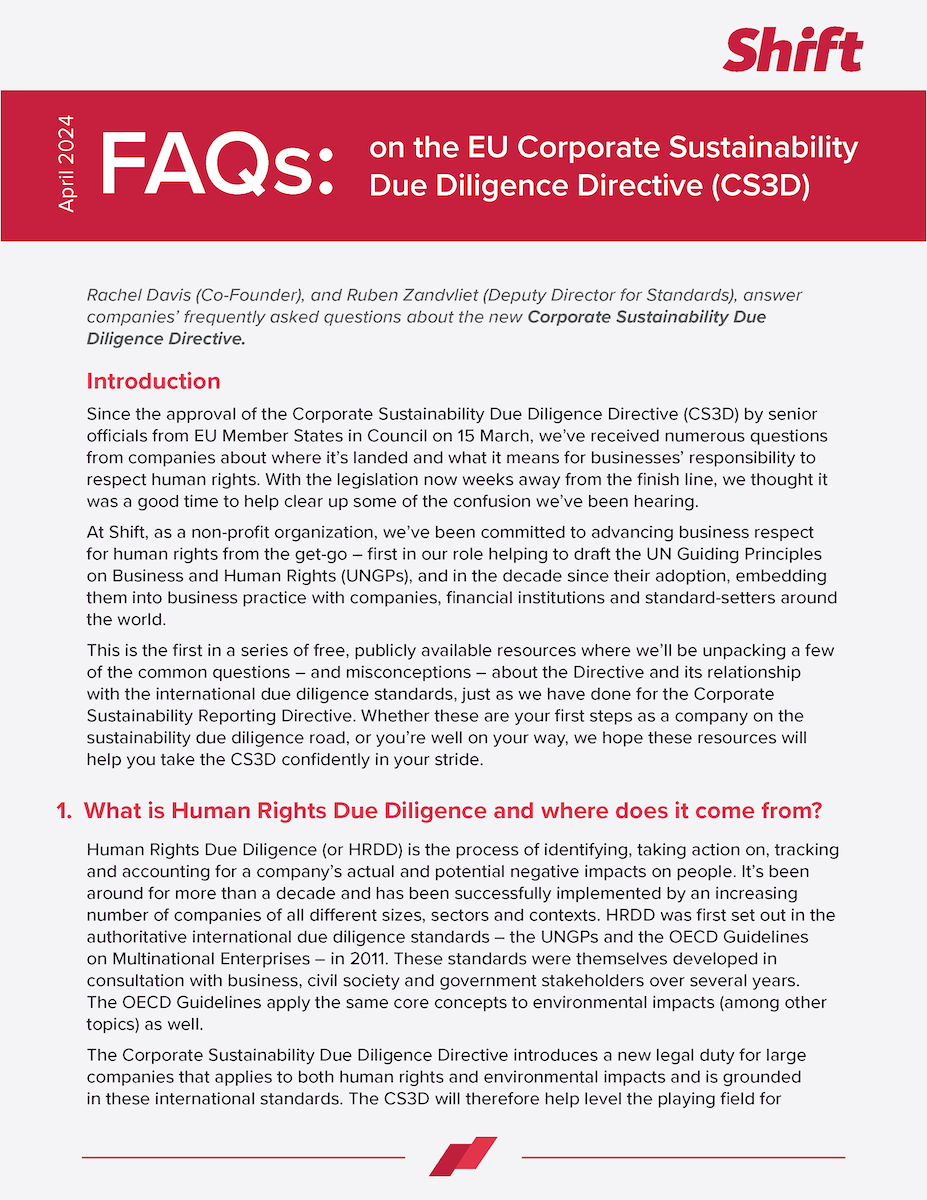

Frequently Asked Questions about the EU Corporate Sustainability Due Diligence Directive

In this resource, Rachel Davis (Co-Founder), and Ruben Zandvliet (Deputy Director for Standards), answer companies’ frequently asked questions about the new Corporate Sustainability Due Diligence Directive.

Since the approval of the Corporate Sustainability Due Diligence Directive (CS3D) by senior officials from EU Member States in Council on 15 March, we’ve received numerous questions from companies about where it’s landed and what it means for businesses’ responsibility to respect human rights. With the legislation now weeks away from the finish line, we thought it was a good time to help clear up some of the confusion we’ve been hearing.

This is the first in a series of free, publicly available resources where we’ll be unpacking a few of the common questions – and misconceptions – about the Directive and its relationship with the international due diligence standards, just as we have done for the Corporate Sustainability Reporting Directive. This includes:

- What is Human Rights Due Diligence and where does it come from?

- Is the CS3D some new kind of ‘European due diligence’?

- Is the CS3D aligned with the international due diligence standards on business and human rights?

- What is the role of administrative supervision in the enforcement of the CS3D?

- What does civil liability in the CS3D apply to? What does this mean for companies?

- What about Member States – what are they required to do?

- As a company, what can I do now?

- What about impacts in downstream business relationships – are these still covered by legislation?

Whether these are your first steps as a company on the sustainability due diligence road, or you’re well on your way, we hope these resources will help you take the CS3D confidently in your stride.

As a non-profit organization, Shift has been committed to advancing business respect for human rights from the get-go – first in our role helping to draft the UN Guiding Principles on Business and Human Rights (UNGPs), and in the decade since their adoption, embedding them into business practice with companies, financial institutions, civil society organizations and standard-setters around the world.

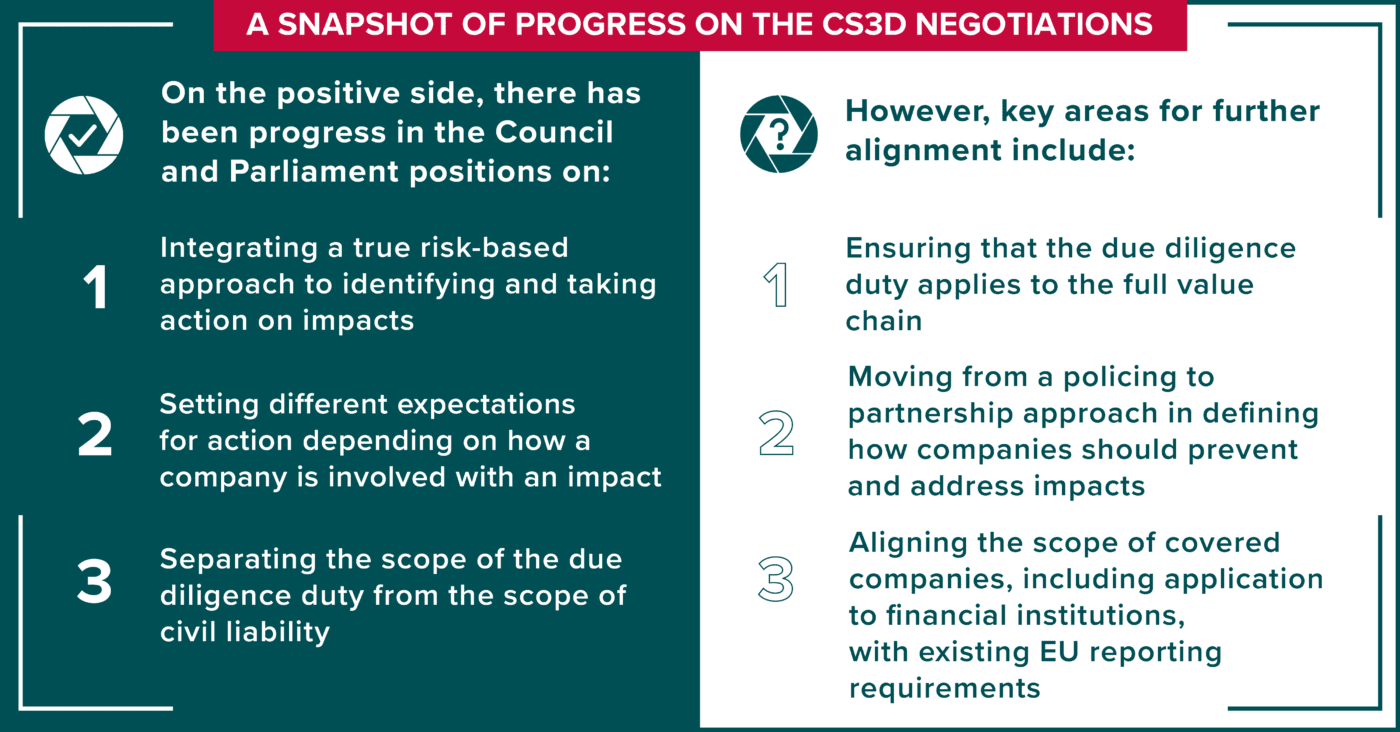

Aligning the EU Due Diligence Directive with the International Standards: Key Issues in the Negotiations

Aligning the CS3D with the core concepts in the international standards

The EU is currently in the process of negotiating a legal instrument that will establish new corporate human rights and environmental due diligence duties across the single market – the draft Corporate Sustainability Due Diligence Directive (CS3D). At the heart of the negotiations is how to ensure the CS3D is meaningful in driving better human rights and environmental outcomes while also being manageable for companies.

This crucial phase of negotiations is a vital opportunity to align the CS3D with the core concepts in the international standards. The international standards on sustainability due diligence – the UN Guiding Principles on Business and Human Rights (UNGPs) and the OECD Guidelines for Multinational Enterprises (OECD Guidelines) – help answer precisely that question, so it’s not surprising that the negotiators’ positions have increasingly built on the core concepts in these standards. Not only have they been shown to work in practice – diverging from them in the CS3D would risk creating a fragmented and confused approach, especially for the many companies that have already been working to implement them.

In this report, Shift takes stock of where progress has been made – and where work still remains – to ensure greater alignment between the positions of the three EU political institutions – the Commission, Council and Parliament – and the international due diligence standards.

Shift’s Submission to the ISSB’S Consultation on Agenda Priorities

The ISSB has proposed that two of the four options for inclusion in its agenda priorities for the next two years could be ‘human capital’ and ‘human rights’: both social-related topics. This is an important and welcome signal, which in turn reflects the significance of these issues to the interests of investors. In light of regulatory and legislative developments related to human rights due diligence, this interest in reporting on social-related issues is set to continue increasing at a rapid rate.

Shift therefore strongly endorses the need for the ISSB to include within its near-term agenda research work that would lead towards a standard on social-related financial disclosures.

This submission to the ISSB’s public consultation sets out the key challenges with addressing social issues through its proposed approach, including the difficulties arising from its proposed categorization of ‘human capital’ and ‘human rights’. It proposes an alternative approach that would focus instead on the development of a cross-cutting social standard that would align with the ISSB’s stated objectives by:

- encompassing issues relevant to both human capital and human rights, avoiding any need to draw boundaries between them, and without needing to address the specific topics they cover in detail,

- meeting the most essential needs of the providers of capital regarding material social-related issues by enabling them to assess the extent to which any company is equipped in its core governance, strategy and risk management to identify and manage social-related risks in its operations and value chains

- establishing the global, foundational building blocks for reporting on social issues, following much the same approach as the ISSB Climate standard S2: mirroring the structure of standard S1 on General Requirements, but extending beyond its content by addressing significant factors particular to social-related issues

- being coherent and interoperable with the existing European Sustainability Reporting Standards (ESRS) on social issues, including by providing a common understanding of the relevant architecture of social-related topics in sustainability reporting

- providing a resource-efficient project that the ISSB could reasonably undertake in its immediate work plan, being (a) broader but less granular than either of the two proposed projects, (b) able to leverage substantial existing resources including the international standards on human rights due diligence and the ISSB’s own CDSB Framework for Reporting Environmental and Social Information.

The submission sets out the detailed rationale for this approach, the benefits it would bring and the resources on which it could draw.

Understanding business impacts on people: the complementary approaches of ‘business and human rights’ and ‘social and human capital’

The fields of ‘business and human rights’ and ‘human and social capital’ address the management and measurement of business impacts on people – but there is often confusion about where these approaches overlap and where they diverge.

This is partially due to their distinct starting points: the field of ‘business and human rights’ is founded on the proposition that all companies have a responsibility to respect the human rights of people affected by their operations, products and services – this is articulated in the UN Guiding Principles on Business and Human Rights and reflected in a range of other standards. The field of ‘Social and human capital’ is part of the ‘capitals approach’ to decision-making which is grounded in the principle that natural capital, social capital, human capital and produced capital form the foundation of human wellbeing and economic success. By understanding how they impact and depend on the capitals, companies are supported to make holistic decisions that create value for nature, people and society alongside businesses and the economy.

In this paper, Shift and the Capitals Coalition set out the key similarities and differences between the two approaches and outline how they can be applied together to inform business decision-making. This includes a closer look at terminology, outcomes and impacts, and their shared focus on people.

Putting the European Sustainability Reporting Standards into Practice

Shift’s Guidance on the European Sustainability Reporting Standards

Primers for practitioners

7 resources

Understanding Assurance in the ESRS

Part 7

Stakeholder Engagement in the ESRS

Part 6

Targets and Metrics: Key Principles for Tracking Performance on Material Impacts

Part 5

Governance, Strategy and Business Models: four highlights from the European Sustainability Reporting Standards

Part 4

Taking a Risk-Based Approach to the Value Chain

Part 3

The People Centered Architecture of the European Sustainability Reporting Standards

Part 2

Double Materiality: What you need to know

Part 1

Shift’s series of primers on the European Sustainability Reporting Standards (ESRS) is for everyone and anyone tasked with putting the standards into practice – whether you’re working within a company, or advising one. The Standards are designed to ensure greater rigor, completeness and comparability in companies’ reporting on their sustainability performance across environmental (including climate), social (primarily human rights) and governance issues, in line with the EU’s Corporate Sustainability Reporting Directive (CSRD). We hope this series supports the coherent interpretation and robust implementation of the standards that will unlock high-quality reporting on sustainability.

As a ‘co-construction’ partner in the early development of the ESRS, and with our Director of Business Engagement, David Vermijs, sitting on the Sustainability Reporting Board (EFRAG) that guided the process, we are glad to be able to help demystify the standards for practitioners.

The need for guidance

The ESRS are set to apply to more than 50,000 companies in the EU and at least 10,000 companies outside. To say the advent of the standards has generated a flurry of activity would be an understatement; companies are now bringing together parts of their organizations that rarely met before – finance and internal audit, compliance and legal, environmental teams and human rights specialists. There are questions about who should lead and whether and how these different experts might work together to apply the standards. And many companies are spending significant amounts of money on hiring consultants to guide them through the process.

So it’s understandable that we’re already seeing a proliferation of interpretations of the standards. The ESRS are hardly drafted in the most accessible terms – indeed, it seems to be the fate of many reporting (and other) standards, to be unhelpfully technical and complex in ways that risk undermining their actual intent.

In addition, consultants are often inclined to interpret standards in ways that best suit the methodologies they are used to applying with their clients. Selective interpretations can come into play as part of a desire to fit these advisory engagements into ‘business as usual’. Indeed, there are cases where internal company experts familiar with key aspects of the ESRS have had to correct their consultants on what they know to be faulty advice. But many more companies lack the in-house expertise to tell the difference.

Clarity is greatly needed. The European Financial Reporting Advisory Group (EFRAG), which was responsible for drafting the standards, will be developing some key guidance over the coming weeks and months; Shift team members David Vermijs and Michelle Langlois will be supporting this process, which will hopefully go some way to addressing gaps in understanding and preventing misinterpretation.

In the meantime, we hope this series of primers will help to answer some of the most frequently asked questions we hear on key aspects of the standards, with a particular focus on social issues and their connections with international standards on human rights due diligence. The series will cover: “double materiality” – and the links between impact materiality and “salient human rights issues”; the novel people-centered architecture of the Social standard; the risk-based approach to identifying material impacts in the “value chain”; and much more.

Bridging the gap between action and reporting

Why are we doing this? Because interpretation matters. It is no accident that the ESRS align closely with the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises – the international standards of conduct on corporate respect for human rights. This ensures that reporting requirements tally with international expectations of how companies identify and address risks to people in their operations and value chains.

Too often, that connection between action and reporting on sustainability has been tenuous – whether that’s because non-financial reporting has been seen by companies as a PR side-show; or because the data demanded of companies has failed to either reflect or support good management of sustainability risks and impacts.

Sustainability reporting should be a natural extension of action – to ensure the authenticity of insights provided to shareholders and other stakeholders, and to ensure that the data being gathered is of value for internal managers. It is this relationship that turns the costs of reporting into an investment in effective risk management. If a hundred interpretations of the ESRS now emerge, that prize will be lost.

The coming months and years will be a litmus test for whether the ESRS can re-solidify this relationship between action and reporting on sustainability matters, including on material social issues that have too long been ignored or downplayed. If not, this pioneering European initiative will in good part have failed. Now is the time to make sure that it succeeds. We hope that this series of primers can help you play a part in helping ensure that it does.

Call for the ISSB to prioritize development of a thematic social-related disclosures standard

The International Sustainability Standards Board (ISSB) has issued a proposed set of future Agenda Priorities for public consultation. These include both ‘human capital’ and ‘human rights’ with regard to social issues. Shift, the B Team and the World Benchmarking Alliance share a concern that this approach will foster further confusion and complexity in the market given the extent to which these two categories are overlapping and intertwined.

In this set of ‘key messages’ we jointly highlight the important opportunity ISSB now has to set the right foundations for disclosures on social matters by starting with a general thematic standard, much as it did for climate. This would enable a clear architecture for social issues and deliver the contextual information that investors need regarding those aspects of corporate governance, strategy, risk management and metrics that are particular to social matters. Our three organizations are disseminating these messages in the hope that they resonate with others who may be responding to the ISSB consultation. We invite everyone to draw from them as they see fit.

Designing an EU Due Diligence Duty that Delivers Better Outcomes

What is the CS3D?

Starting in 2022, the European Union has been negotiating a draft Directive on Corporate Sustainability Due Diligence (CS3D), with discussions on a final law expected to begin by mid-2023. The draft Directive aims to ensure companies active in the single European market contribute to sustainable development by preventing and addressing negative human rights and environmental impacts.

How can we ensure the directive delivers for people and planet?

In our latest report, From Policing to Partnership: Designing an EU Due Diligence Duty that Delivers Better Outcomes, we set out clear recommendations to better align the core content of the duty to do due diligence in the draft Directive with the authoritative international standards for sustainability due diligence.

While the new duty will only apply to certain companies headquartered or operating in the single market, their business partners and other companies in key sourcing and production markets outside the EU will have an essential role to play. Our report is based on interviews with businesses and other stakeholders in Bangladesh, Kenya, Tanzania, and Thailand on the challenges and opportunities facing local companies in meeting their EU business partners’ human rights and environmental expectations, and in preventing and addressing human rights impacts in their operations.

The report looks at some of the current dynamics between EU companies and their non-EU business partners in managing human rights risks, and explores the opportunity the Directive presents to shift from a top-down ‘policing’ approach to one based on collaboration and mutual responsibility, in line with the international standards. It aims to bring the perspectives of companies in key markets into the current debate to provide vital insights into the kinds of practices and behaviors that should be incentivized in the new Directive – and those that should be discouraged – if we truly want it to deliver better outcomes for people and planet.

This report is divided into two main sections:

Section B, What did we hear? provides an overview of current behaviors and practices that are often not conducive to meaningful human rights due diligence.

Section C contains two parts:

- What is different about the international standards? benchmarks some of the problematic practices encountered against the international due diligence standards. It highlights what would signal more meaningful due diligence approaches, as compared to those that currently seem to dominate many of the relationships between EU companies and their business partners.

- What is the opportunity? underscores the potential for the CS3D to define a carefully crafted due diligence duty that incentivizes a shift towards practices that are more aligned with meaningful due diligence.

This research is part of a project funded by the Ministry for Foreign Affairs of Sweden.

Comments by Shift on the Draft Report on Minimum Safeguards

Shift welcomes the publication of the Draft Report on Minimum Safeguards by the Platform on Sustainable Finance, and its call for feedback on the content and recommendations. The report bypasses simplistic approaches and grapples with the challenge at the center of this endeavor, which is how to assess the adequacy of a human rights due diligence process – and how to do so at scale.

There is no single or simple way to meet this challenge, not least because current data in the public arena on companies’ social performance is not up to the task. At the same time, the report rightly notes that developments relating to EU reporting requirements are set to change that reality, and should increase the availability of high-value information. Of course, in many cases, this will still require that analysts and assurance providers have the skills to contextualize and assess that information.

We believe the report’s recommendations point in the right direction, but may require further elaboration in some instances. We also recognize that a first version of the safeguards will be – and should be explicitly acknowledged as – a starting point grounded in today’s best ‘art of the possible’, that will need to further evolve in the years to come, as available data and experience with social indicators improve.

This document contains our comments on the Draft Report on Minimum Safeguards, which were submitted to the Platform on Sustainable Finance.