Between 2018 and 2020, as part of Shift’s Valuing Respect project, we identified numerous approaches that companies can take to measure the quality of relationships in their supply chains and operating contexts. We spoke with diverse business leaders, independent evaluation practitioners, worker voice innovators, non-governmental and advocacy organizations to build up a state of play in this area. This section summarizes what we learned.

Key Takeaways

1. THE QUALITY OF RELATIONSHIPS BETWEEN COMPANIES AND AFFECTED STAKEHOLDERS CAN BE MEASURED IN DIVERSE SECTORS AND CONTEXTS.

The quality of relationships between companies and affected stakeholders can be measured in diverse sectors and geographies, and in their own operations and at points in the value chain.

The majority of methodologies we identified and have outlined in this resource are sector agnostic, though their application will look different depending on whether a company is focusing on a workforce, impacted community or consumers. This resource profiles innovations happening in different sectors including agriculture, electronics, energy, extractives, food & beverage and textiles. And our learning shows measurement efforts are taking place across multiple geographies ranging from South Africa to China to Indonesia.

A company may have direct contact with the affected stakeholders concerned to evaluate relationships between itself and those stakeholders, but that does not always need to be the case. For example, in the Gold Fields relational assessment case study, we present how this global mining company has been measuring host community support in mining operations in South Africa. But other companies – such as PMI and Nike – are looking into their supply chains to better understand relationships among workers, supervisors and management in factories, fields or mills.

What is clear is that active support and participation of the business leaders and managers that own the direct relationships with affected stakeholders is key, and this often relies on there being a clear business case for analyzing and improving relationships with affected groups. In our case study of Best Buy, we discuss how the company’s assessment of changes in supervisor-worker relationships helped the company and its supplier in China improve behavior change training for managers.

The methods also profiled in this resource can all be applied at different levels of scale: for example, between companies and large populations across disparate locations and sites (such as workers at supplier sites across a geographic region) or between a company and large populations in a specific location (such as communities around a large footprint site, or large volumes of workers all located in an export processing zone or agricultural region). The key is that companies will need to design assessments to ensure they can invest the time and attention needed to digest and act on findings. And the larger and more representative the population from which companies seek input, the more it will allow companies to be confident that patterns in data offer a sound basis for judgement, learning, and improvements.

2. METHODOLOGIES TO ASSESS THE QUALITY OF RELATIONSHIPS BUILD ON BEST PRACTICE IN TRANSLATING QUALITATIVE DATA INTO NUMBERS.

Methodologies to assess the quality of relationships broadly follow the same general process steps and all build on best practice in translating qualitative data into numbers. There are differences in the details, such as in the ways and frequency at which data is collected, and the depth of involvement of affected stakeholders in interpreting data. Company practitioners should therefore evaluate which methods best suit their objectives and needs.

The approaches profiled in this resource will not be entirely new to companies. They all include the same broad steps from design to data collection to data analysis and visualization to learning to establishing action plans. This broad “plan, do, check, improve” cycle will be familiar to most companies. Moreover, many companies already translate people’s subjective views into metrics and numbers, most notably in the context of market research, risk evaluation and human resource management via employee surveys.

Beyond these foundational similarities, there are differences in the details across the case studies and methodologies profiled. In particular:

- Regarding frameworks and indicators: The ICMM’s Understanding Company-Community Relations Toolkit sets out four dimensions of relationships and an associated menu of survey questions that companies can use to measure community support. In contrast, other approaches do not pre-define these but instead elaborate principles to guide the design of an assessment framework. For example, the Constituent Voice and SenseMaker methodologies include active involvement of affected stakeholders to design the most relevant and context- specific questions for each assessment. In the context of integrating relationship-based questions into worker voice tools, the providers of these platforms have developed a pool of questions (many of them listed in the methodology) commonly used by companies.

- Regarding the frequency of data collection: Companies will need to decide when and how regularly data needs to be collected. Factors informing this decision will vary. By way of illustration:

- Gold Fields repeat their relationship assessments with local communities approximately every one-to-two-years. This fits well with existing mine-level planning and is complemented by a constant site-level presence of community liaison officers and frequent community engagement including via open days and townhall meeting.

- Where assessments are intended to evaluate the effectiveness a specific intervention, such as a training program, the program’s timelines will dictate when baseline and end-line data collection occurs. An example of this is Best Buy’s assessment of supplier behavior change training intended to improve relationships between supervisors and workers: a pre-training baseline assessment took place in May 2018 and the final assessment was completed in January 2019.

- In the case of Constituent Voice, the methodology itself stipulates that a company should gather data through 4-to-5 question surveys on a regular basis (for example, every 2 or 3 months). This is because a core proposition of this methodology is that rapid, faster than annual, learning loops based on a flow of data will create a culture of continuous improvement and timely problem-solving.

Opportunities to Adapt and Pilot: The methodologies in this resource are well suited to be adapted to the specific needs of individual companies, and most approaches can be piloted over a period of 6-to-9 months. Undertaking low-cost pilots, even of multiple methods in parallel, is an excellent way for companies to strengthen their own understanding of ways to assess relationships in their own operational and value chain contexts.

3. SURFACING AUTHENTIC STAKEHOLDER PERSPECTIVES IS THE LINCHPIN TO RELIABLY MEASURING THE QUALITY OF RELATIONSHIPS.

Surfacing authentic stakeholder perspectives is the linchpin to reliably measure the quality of relationships. Being inclusive in process, as against just data collection, can be especially impactful in achieving this.

Listening to the perspectives and experiences of affected people can unlock an understanding of the relationships between a company and those stakeholders. In turn, translating stakeholder voice into data provides a basis for tracking changes over time, spotting patterns and informing plans for improving those relationships. However, these data and insights are only valid and valuable if affected stakeholders are able to share authentic perspectives.

In all situations, companies should pay serious attention to stakeholders’ privacy, and sense of safety and security when they are asked to share their experiences and insights. Beyond this, the practical examples profiled in this resource, signal the many dimensions and considerations to maximizing the likelihood that stakeholder voice is authentic. By way of illustration:

- Making it easy for stakeholders to share their views can increase participation rates and the quality of inputs. The more straightforward it is for stakeholders to share their experiences, the more they will do so. There are different approaches to making assessments simple and accessible for respondents. For example:

- Integrating relationship-based questions into worker voice platforms that are already used effectively by companies to engage workers can increase participation rates and the quality of inputs. This is because workers will trust in the tools, believe in their value and likely have built up habits of using the tools, even for other purposes such as participating in e-learning or tracking their overtime.

- One feature of the Constituent Voice method profiled in this resource is to ask a small number of short, simple questions on a regular basis, say every 4-to-6 weeks. The format of a simple question can reduce barriers to understanding, especially where language or literacy rates needs to be considered. And the frequent asking of questions can build familiarity among stakeholders.

- Asking people to tell a story about their lives in their own words can be an effective of way of making engagement easy. In the case of PMI’s evaluation of local cultural dynamics that may impact small-holder compliance with child labor policies, research teams simply provided individuals with cameras to take photos of their daily routine as a basis for conversations about local attitudes, pressures and norms. Similarly, the SenseMaker methodology starts with several hundred or thousand workers or community members being asked to share a 3-to-4-line story based on a prompt in the form of a question.

- Working with experts and local partners can remove barriers to stakeholders sharing views: In the case of Gold Fields’ assessment of its relationships with local communities and in the example of the SenseMaker methodology, emphasis is placed on the value of working with experts and trusted local partners. Collaborating with evaluation experts or local trusted partners familiar with the local context and language improves the quality and independence of the assessment. It can also create a confidential environment for stakeholders to share their experience anonymously, especially when it relates to such a sensitive topic as relationships.

- Listening to diverse sub-groups within the wider population is an important element of enabling authentic voice: All of the methodologies and cases profiled embed some level of attention to uncovering the experience of diverse voices. Achieving this can include:

- Being scientific about sampling such that voices of all sub-groups are heard even when only a subset of the population may offer inputs.

- Interrogating data to spot differences in experiences between demographic groups. Examples of this can be found in the worker voice, Gold Fields and SenseMaker.

- As a general rule, the more inclusive the full assessment process, the more stakeholders will be open and honest about their views and experiences. Moreover, company insight and subsequent actions will be more robust when they “close the loop” by involving affected people in data interpretation and action planning. All of the organizations and individuals referenced in this resource stated that, where possible, assessment processes should be implemented with stakeholder involvement. This represents an important shift from seeking simply to extract data from stakeholders, towards participatory and inclusive methods in which stakeholders are central to inform, co-create, interpret and shape the assessment itself and next steps. By way of illustration:

- ICMM’s Understanding Company-Community Relations Toolkit includes a dedicated step to discuss the results of assessments as well as the next steps with stakeholders. This was indeed part of the work done by Gold Fields in their relationship assessments in South Africa.

- Both Constituent Voice and SenseMaker place extremely strong emphasis on assessment itself as an opportunity to model a relationship in which a company is respectful, takes feedback seriously and takes concrete steps to make improvements. This means that core ingredients to the methodologies are that companies pilot, test and refine questions and other assessment design details with prospective respondents, and “close the loop” by not only sharing results or actions but asking respondents to interpret data and co-create actions.

4. UNDERSTANDING CONTEXTUAL FACTORS IN WHICH RELATIONSHIPS EXIST CAN PROVIDE ADDITIONAL NUANCES AND INSIGHT.

Understanding contextual factors in which relationships between companies and affected people are built, maintained and assessed, can provide additional nuances and insights into the quality of relationships.

Relationships can be shaped by various factors, and local socio-economic, cultural and political dynamics are areas that some companies are trying to understand as a way to contextualize the experiences of affected stakeholders. For example:

- In the assessment of its child labor program, Philip Morris International in Indonesia revealed that dominant social norms continue to shape widespread attitudes towards child labor among farm owners, local leaders and even parents. These local norms prevail over international labor standards embedded in PMI’s supplier compliance requirements. The result is that, in practice, the behaviors of asking or allowing children to help out on farms have persisted.

- ICMM’s Understanding Company-Community Relations Toolkit, explicitly includes contextual factors in the assessment and indicator framework so that companies can inform their interpretation of the results from community surveys and focus groups. The factors included are the Social, Political and Governance Context, the Socioeconomic Context and Industry Reputation.

- Constituent Voice has been applied by the Better Buying initiative to assess and improve the nature of the relationships between buyers and suppliers, which in turn impact the degree to which suppliers engage with and treat workers with respect and dignity.

5. COMPANIES WILL NEED TO CREATE THE INTERNAL CONDITIONS NECESSARY TO IMPLEMENT ASSESSMENTS AND TO ACT ON FINDINGS.

Companies will need to create the internal commitment and conditions necessary to ensure that they implement assessments of relationships robustly and are prepared to act on findings. This involves adopting a “beyond compliance” attitude, as well as being clear about the various actors that will use the data generated and how that data creates value for those users.

Asking workers and communities to share experiences about their lives without being genuinely prepared to act on the responses can create frustration and reduce trust in the relationship. Additionally, assessing the quality of relationships between companies and affected stakeholders requires investment of often scarce company resources. So it makes sense from a business standpoint to ensure that the company is set up to benefit from such an exercise.

An important condition for successfully using the methodologies in this resource is that companies see the assessment of relationships as an exercise in evidencing and achieving progress, rather than as a compliance exercise. There are significant risks in using these methods to put pressure on, or penalize, companies or employees that own relationships with affected stakeholders. It can incentivize those actors to coach or even coerce workers and community members to respond favorably to assessments, or simply nudge organizations to suppress uncomfortable findings. In both cases, the result is that data will be distorted, so lacking any objective value to users, and assessment processes will erode and damage relationships.

It is also important that companies have some clarity about who within the company, and at different points in the value chain, is intended to explore the data, gain insight from it and ultimately act on it. This clarity will grow over time as a company implements assessments, but having a starting proposition is important. By way of illustration:

- In the case of Gold Fields’ relationship assessment, different parts of the company engage with and make decisions based on the data.

- The board discusses trends in aggregate community support scores as well as select headlines to provide nuance to this topline finding. This informs budget and human resource allocation.

- The corporate-level sustainability team is able to understand whether and why polices, programs and initiatives aimed at improving relations with communities are working. This informs their own support to teams on sites.

- Site-level employees – including mine managers and Community Liaison Teams – can interrogate data to identify how to adapt company practices and modes of stakeholder engagement. This includes establishing a clearer picture of how the experiences of stakeholders differ between demographic groups.

- In the case of Constituent Voice, the methodology is strongly focused on data informing judgements across supply chains. For example:

- Senior leaders within global brands and owners of production sites that supply the brand can track changes in a single metric, called the “Improvement Rate”, for different geographies or sites that reflects responses to 4-or-5 questions being asked of workers.

- Site-level managers can use the data to inform joint learning and problem-solving with workers aimed at making quick, demonstrable improvements while also creating a culture of openness and mutuality in the relationship.

- The method can also be used to assess and improve the nature of the relationship between buyers and suppliers, which in turn impacts the degree to which suppliers engage with and treat workers with respect.

- In relation to integrating relationship-based questions into worker voice tools, a common practice is to cross-reference data about workers’ experiences with traditional business metrics concerning worker retention, absenteeism, and productivity. These efforts can:

- Provide data to management at employment sites about the relationship between improved relationships with workers and better business performance, so incentivizing improvements.

- Support brands and other buyers to make the business case to suppliers for improving relationships with workers.

- In the Best Buy and PMI cases, which are focused on evidencing the impact of training and other programs, the assessments informed:

- Senior leaders seeking to understand, and possibly communicate publicly about, the impact of the company’s programs.

- Sustainability teams tasked with implementing programs to embed respect for human rights in the supply chain.

- NGOs and others designing and delivering programs with companies, such that they could reflect on how to enhance their own methods and ways of working.

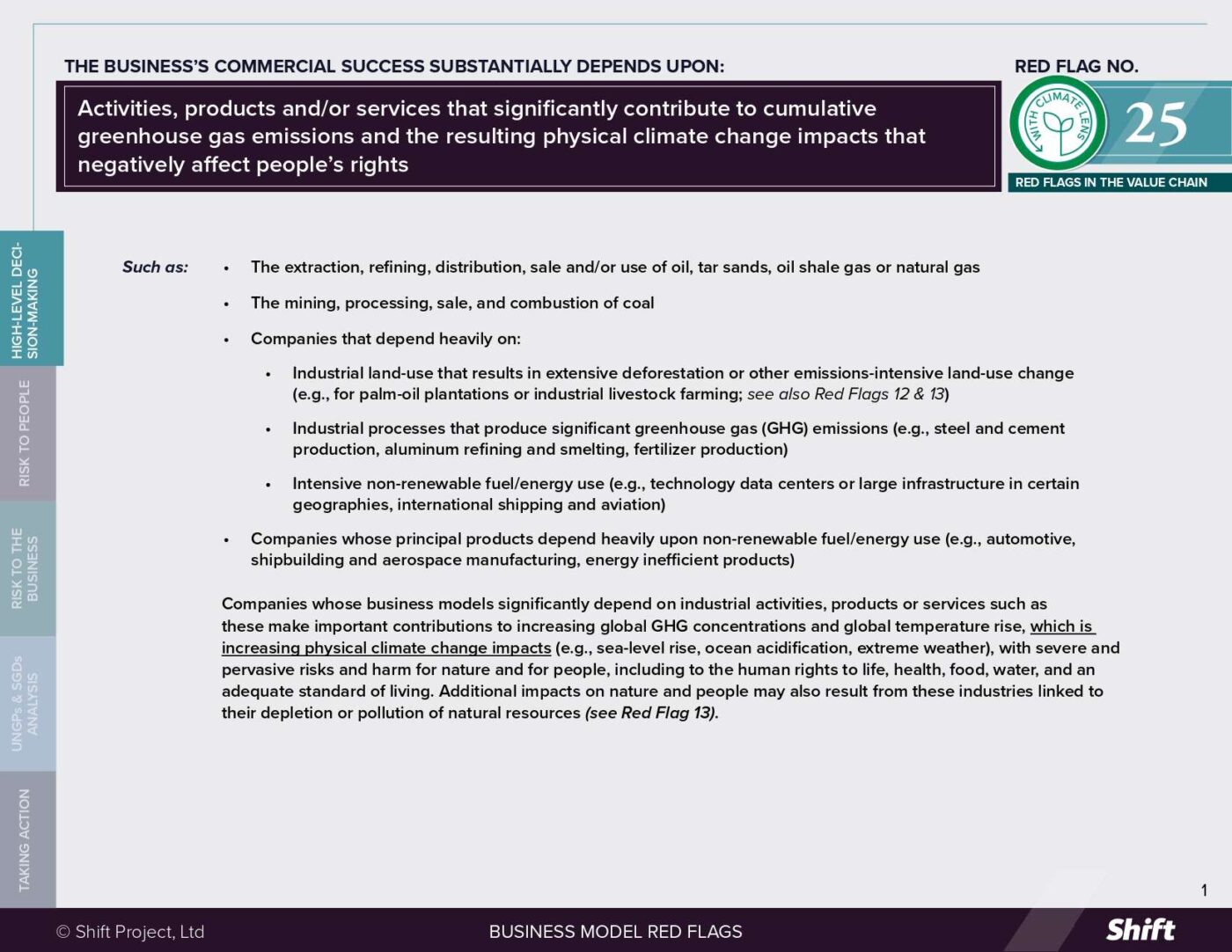

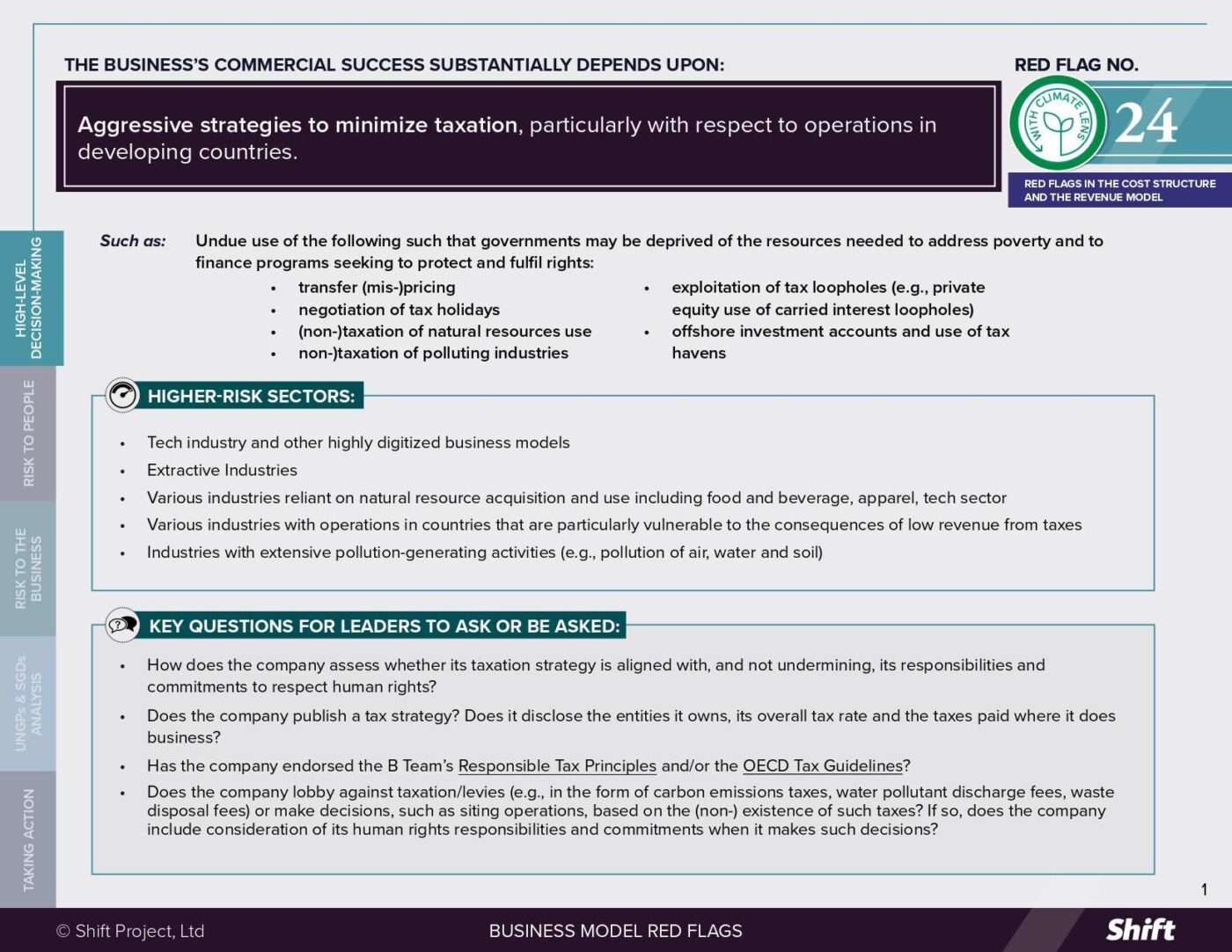

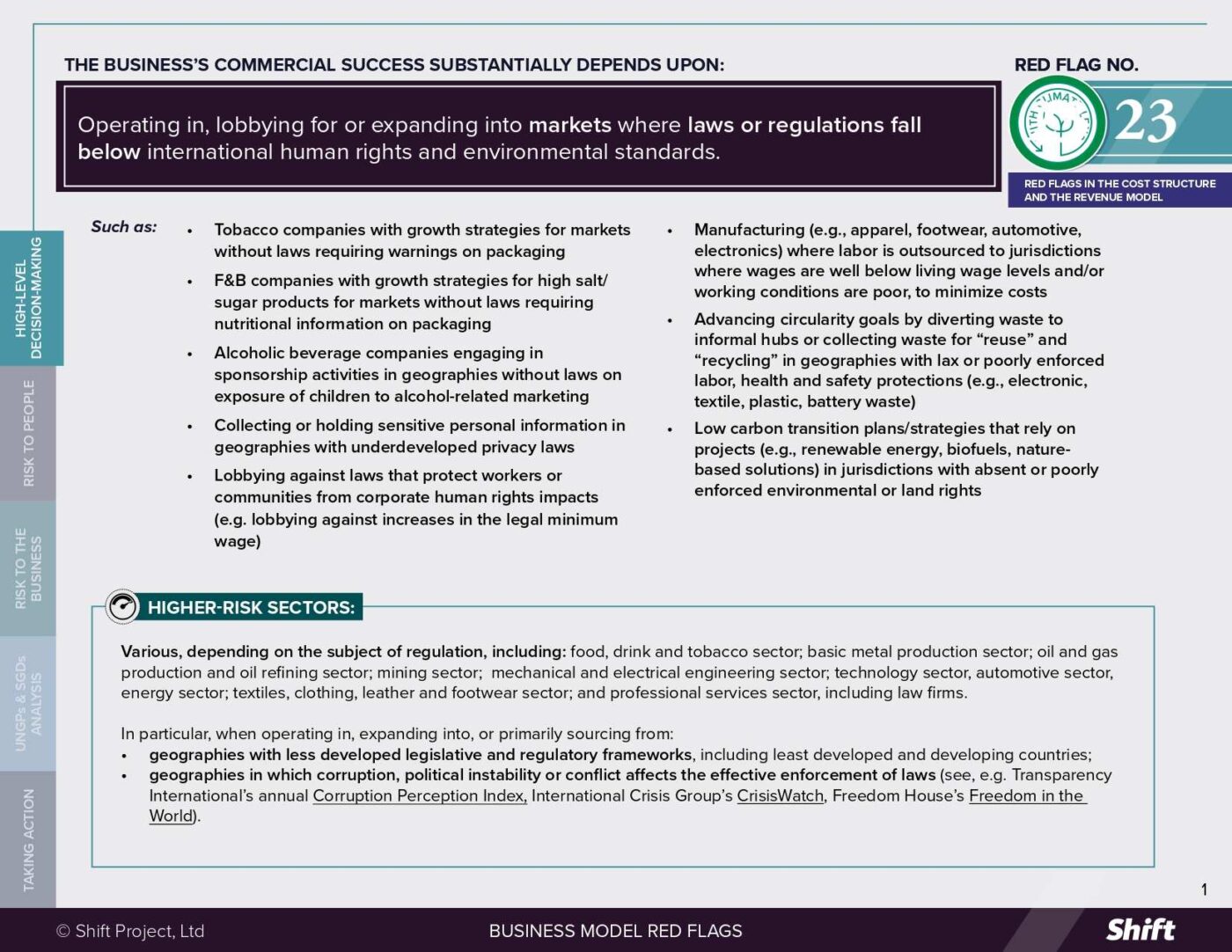

Business Model Red Flags

Business Model Red Flags  Tool for Indicator Design

Tool for Indicator Design